Research: Content & navigation key to default TV source

August 30, 2019

The average consumer now accesses TV shows and movies from more than four different sources of content. The Decoding the Default study from Hub identifies the factors that determine which source consumers turn to first.

Highlights from the study:

1) Ease of navigation and favourite show availability drive consumers’ TV default decisions—and will in large part determine the success of both new and existing services.

- Two factors have the strongest impact on the source consumers choose as their TV default: ease of finding something to watch and access to favourite shows.

- Three additional factors also play a strong role: access to live programming, strong content variety, and ease of binge viewing.

- Right now, no service is best at delivering all these needs. In fact, each source offers a distinctly different set of benefits:

– Traditional pay TV subscription: Access to live programming

– Netflix: Lack of commercials

– Hulu: Access to the latest shows

– Amazon: Variety generally

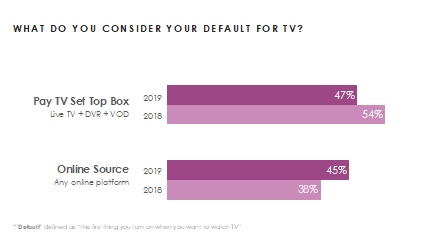

2) For the first time, an online TV source is statistically as likely to be consumers’ default as a source from a pay-TV provider.

- 47 per cent default to TV viewing through their pay-TV set-top box (live TV, DVR, Video on Demand), while 45 per cent default to an online source.

- The pay-TV set-top box has dropped 7 points as a default in just the past year, while online sources have increased 7 points.

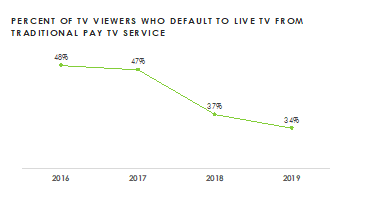

3) Linear viewing from a cable, satellite, or telco TV subscription has reached its lowest level as a default source of TV.

- Only one-third of TV consumers say the first thing they turn on when they want to watch is linear TV from their traditional pay-TV service—shows and movies airing on their regularly scheduled time and network.

- In fact, the per cent defaulting to linear TV has dropped 14 percentage points in just three years.

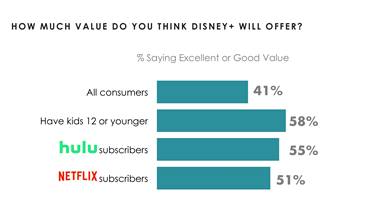

4) Looking at the soon-to-launch sources, Disney+ already has an edge as a potential default source, with many feeling it will offer strong value for the money.

- Majorities of consumers with kids 12 or younger—as well as a majority of current Netflix subscribers, with or without kids—rate the proposed service and its $6.99 monthly price tag as an excellent or good value.

“With its low monthly price point and proposed variety of content, it’s not surprising that consumers in Disney+’s crosshairs – households with kids and Netflix subscribers – see it as offering strong value for the money,” said Peter Fondulas, principal at Hub and co-author of the study. “Whether its value proposition is strong enough to make Disney+ viewers’ first stop for TV is of course yet to be seen. But by bundling Disney+ with Hulu and ESPN+, the combined package stands to tick off many of the boxes consumers consider must-haves for a default service.”

The data cited here come from Hub’s “Decoding the Default” study, conducted among 1,678 US consumers with broadband, who watch at least 1 hour of TV per week. The data was collected in August 2019.