Report: Pay-TV remains top buyer of US scripted content

October 10, 2019

Despite the growing dominance of subscription services with global buying power, pay-TV channels are still licensing the most premium US dramas in major revenue generating markets.

Despite the growing dominance of subscription services with global buying power, pay-TV channels are still licensing the most premium US dramas in major revenue generating markets.

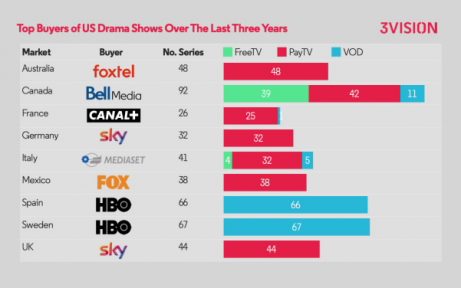

Over the last three years, pay-TV channels have been the most important buyers of US scripted shows according to data from the 3Vision Show Tracker service. Monitoring the distribution of all US scripted shows in the top 12 global markets, 3Vision’s Show Tracker captures 22 parameters for each programme, including platform, window and catch-up utilisation.

Only in Spain and Sweden, did SVoD platforms emerge as the leading US drama buyers with standalone subscription services HBO España and HBO Nordic making over 60 ‘1st window’ acquisitions each over the past three years. In Australia, pay-TV player Foxtel bought 1st window rights to 48 US shows that have premiered in the market over the past three seasons. In terms of volumes they are closely followed by Bell Media in Canada and Sky in the UK.

In some instances the number of shows can be explained by output deals, an agreement whereby the complete catalogue will be bought – Sky has an output deal with HBO – including the upcoming Watchmen series (pictured) while Bell Media has a similar deal with ShowTime.

Despite the continued importance of pay-TV channels as key programme buyers, SVoD platforms are starting to catch up. For instance, in Australia, Nine Entertainment’s SVoD service STAN has acquired 37 series (against Foxtel’s 48).

Jack Davison EVP at 3Vision says that “we are looking forward to seeing the numbers this time next year – to understand the impact of the launch of the Studios’ D2C initiatives, but also the push into originals by pay-TV services like Sky. While this will likely see some high profile US shows withdrawn from sale to preserve exclusivity on D2C services, we expect there still to be plenty of possibilities for other services to find and acquire content, with new window continuums, co-exclusivity and straightforward deals likely to still be possible for many.”