Report: Streaming war intensifies in CEE

March 31, 2022

2022 is set to be a decisive year for streaming platforms’ market expansion across Europe, with an especially busy launch calendar in Central and Eastern European markets, reports Dataxis.

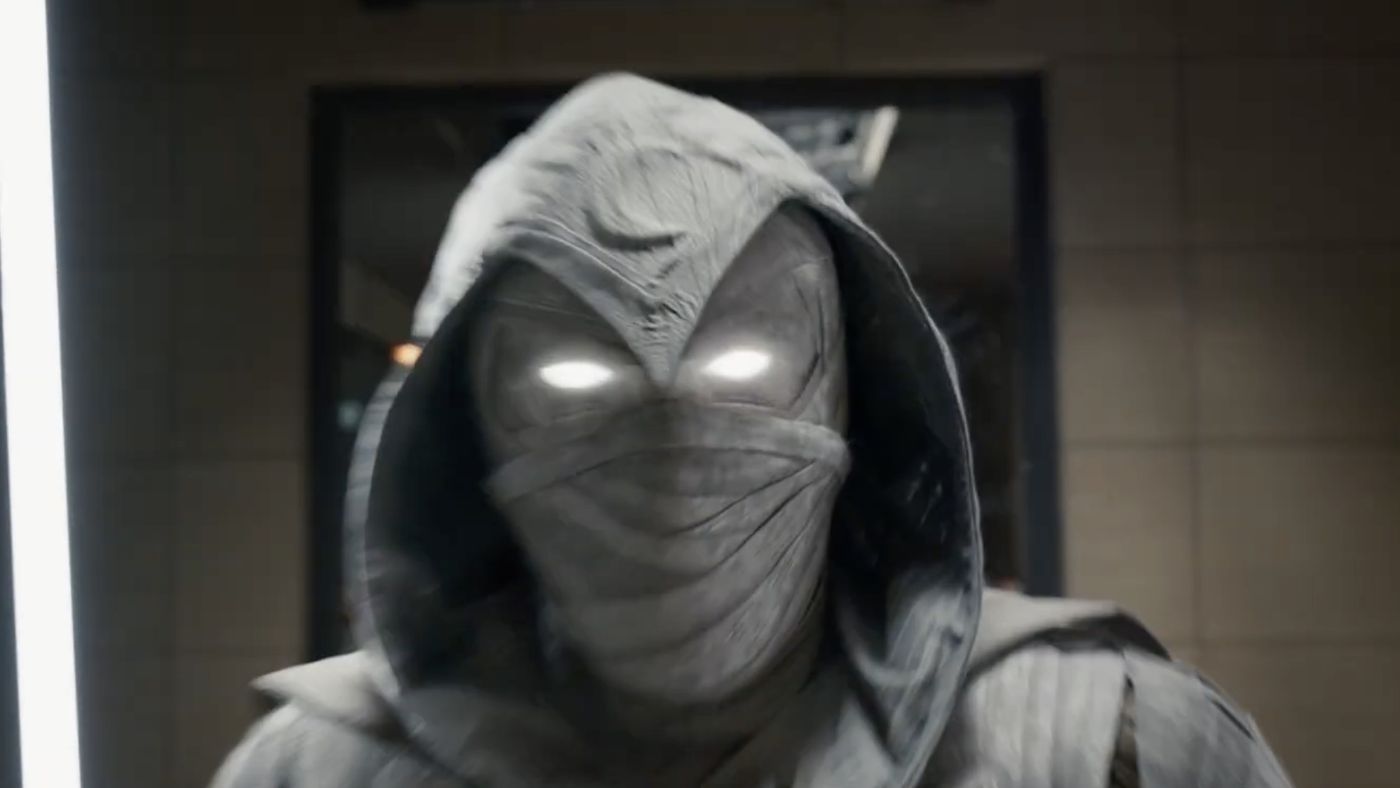

On March 8th, HBO rolled out its new streaming service HBO Max across Central Europe, where the broadcaster was already well implanted since the launch of HBO Go in the region back in November 2017. Thanks to a drop in pricing, with the cheapest subscription starting €2 lower than previous HBO Go plans, and attractive promotions at launch, the service is expected to gain momentum across the region and drive a significant amount of new subscriptions, says Dataxis.

Netflix announced this week the opening of a new office in Poland dedicated to investments in local productions and aiming at boosting the service’s expansion across neighbouring markets. The global SVoD giant remains the regional market leader in terms of subscribers and revenues, but competition is set to significantly increase in the region and investing in local content has become a must for the platform to retain its position.

Disney+ is pursuing its international expansion and has confirmed its launch date in CEE markets for mid-June 2022. Discovery, which has recently rebranded its DPlay service into discovery+ across Nordics markets, Benelux and Italy, is also expected to roll out in further countries in Europe in the upcoming quarters.

Back in early 2021, the platform signed a partnership with one of the biggest European telco operators, Vodafone, to include discovery+ in the latter’s content offers. Dataxis believes this could push for an early rollout in Vodafone’s active markets in the region: Romania, Czechia and Hungary.

Another significant actor set for launch in 2022 is newcomer SkyShowtime, an international platform created from a partnership between Comcast and ViacomCBS, announced in August 2021. The streaming service would bring together content from NBCUniversal, Sky and ViacomCBS, including titles from Showtime, Nickelodeon, Paramount Pictures, Paramount+ Originals, Sky Studios, Universal Pictures and Peacock. As this joint service won’t be launched in Sky markets (UK, Ireland, Italy and german-speaking markets), Dataxis believes the platform is likely to focus its European rollout in CEE markets where the uptake in VoD subscriptions has been growing faster than in already crowded Western European streaming markets.

Regarding European actors, Viaplay chose to start its international expansion last year by launching first in Baltic markets, where video consumption and subscription uptake are drawing near to what has been seen in neighbouring Nordic markets, and then in Poland, where the platform’s launch was backed by early partnerships with several of the country’s main telco operators for a faster rollout across Polish pay TV households. Upcoming market launches have been announced for the second half of 2022 in the UK, Canada and German-speaking countries, thus excluding opportunities in other Central and Eastern European markets for now. Viaplay’s rollout is highly relying on content and sports rights acquisition in its active and prospective markets, to stay in line with its original line-up. But an upcoming launch in more European markets is not unlikely as the Nordic platform expects to reach 6 million subscribers outside of its native markets by 2025, says Dataxis.

US networks used to account for almost a quarter of total TV revenues generated in Central Europe, with Discovery, WarnerMedia and Disney leading the way. With TV consumption declining, pay-TV affiliate fees are under a growing pressure and US broadcasters are increasingly capitalising on direct-to-consumer platforms to compensate the shortfall in TV channels distribution revenues. If Central and Eastern European markets have been lagging behind Western European countries in terms of paying video streaming services’ penetration, the upcoming arrival of those new entrants and their attractive video offers will significantly change the content landscape in the region, Dataxis concludes.