Research: AVoD 32% of video consumption

October 31, 2022

Research from entertainment technologist TiVo finds that the average number of video services used by North American consumers is approaching double-digits for the first time in history, up to an average of 9.86 video services from 8.8 a year ago.

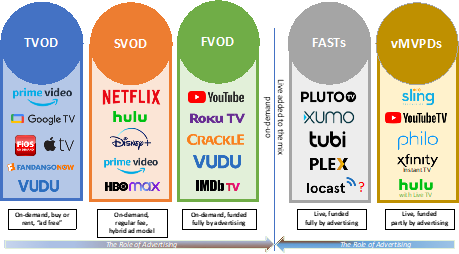

According to the TiVo Video Trends Report, contributing to the rise is an increase in adoption of ad-supported video on demand (AVoD) services, also referred to as free ad-supported streaming TV (FAST); AVoD services account for 32 per cent of the overall share of video services used by consumers in 2022, compared to 26 per cent in Q4 2021; and the average consumer is now using three ad-based video on demand services.

While consumers’ willingness to pay for ad-free programming has been an advantage to subscription streaming services in recent years, that trend is now giving way to increased adoption of ad-supported video fuelled by a proliferation of free content services or introduction of subscription tiers, according to the report. At the same time, a rich-content first experience remains a priority when it comes to discretionary spending. In fact, seven in 10 of respondents said their video entertainment spending is a moderate to high priority. Despite inflation and financial pressures, only 25 per cent of respondents reported reducing their entertainment spending. Three in 10 consumers surveyed said they had purchased a smart TV between Q4 2021 and Q2 2022.

“The results in the TiVo Video Trends Report highlight that while video entertainment remains a priority for the vast majority of consumers, FAST services allow consumers to stretch their entertainment dollar,” advises Michael Goodman, Director, TV & Media Strategies, Strategy Analytics. “Giving them additional entertainment options at no additional cost. In uncertain economic times this financial flexibility is much appreciated by consumers.”

“Entertainment, and specifically video content, is very much a priority for consumers, but if they can get it at a lower-cost, or free, consumers are demonstrating a growing tolerance for more ads as part of the content they consume,” added Walt Horstman, senior vice president, Monetisation, TiVo, a part of Xperi, Inc.

Additional findings:

Hopping around: Eight in 10 consumers said they wish their paid service offered an ad-supported free option, but a quarter (24.3 per cent) of AVoD users admitted to only spending three months watching a new AVoD service until moving onto a new option. Moreover, pay-TV subscribers admitted to hopping between AVoD services at more than twice the rate of broadband-only users.

Too many options: Finding what consumers want to watch continues to be the number-one pain point for the vast majority, as services and content proliferate. Voice control is more popular than ever, with three-quarters (74 per cent) of respondents who have access to voice search technology using it to help find content faster.

In the neighbourhood: 59 per cent of survey respondents consider local content to be important or very important, with local weather (68 per cent), news (65 per cent) and sports (36 per cent) topping their list of tune-in priorities. Pay-TV subscribers spend a quarter (24.6 per cent) of their viewing time on local content, while broadband-only subscribers spend 16.2 per cent of their viewing time watching local content.

Cord-cutters come back: 25 per cent of pay-TV subscribers are reported ‘Pay-TV Revivers’ who once cut the cord and resubscribed. TiVo’s research team points out that pay-TV continues to have a significantly lower churn rate than subscription video on demand (SVoD).