Report: European AV players growing faster than market

January 25, 2023

The European Audiovisual Observatory, part of the Council of Europe in Strasbourg, has published its annual report on key AV players in Europe.

The report, Top players in the European audiovisual industry – ownership and concentration, aims to shed light on the structure of the AV industry in Europe in terms of revenues as well as other performance indicators specific to key audiovisual market segments. The analysis provides snapshots of the top AV players and explores concentration, statute, and origin of ownership by revenues, pay-TV subscriptions, SVoD subscriptions, number of TV channels, number of on-demand services, TV audiences, number of TV fiction titles produced and number of cinema screens. It also provides transversal views for players active in more than one market segment.

The report finds that at the end of 2021:

- The top 100 audiovisual companies in Europe by operating AV service revenues were highly resilient, dynamic and drove the overall AV market growth

- M&A activity surged recently driven by telco players and this activity was more concentrated in the Central and Eastern Europe (CEE) region

- US interests in the European AV industry continued their upward trend as they prioritized direct investments as opposed to the traditional indirect ones

- The top AV players in Europe are eclectic as regards their core business which drives the revenues, as well as their internationalisation strategy

- On the market for pay services, excluding the distribution of third-party services by telcos, broadcasters got the lion’s share of subscriptions within the entire European-owned pay service market.

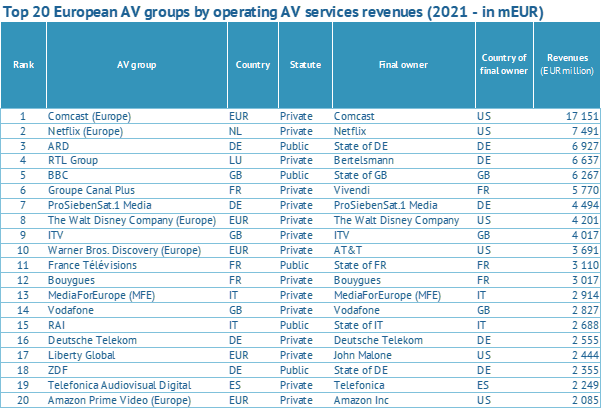

Revenues

The cumulated AV service operating revenues of the top 100 audiovisual companies in Europe grew between 2016 and 2021 twice as fast as the overall market and at a higher pace than that of average inflation. In other words the top 100 companies grew by 17 per cent in 2021 when compared to 2016. The positive evolution of the overall AV service market was due to the highly dynamic development of the SVoD revenues. Meanwhile, the cumulated revenues of primarily traditional players (i.e. broadcasting and pay-TV distribution) among the top 100 also increased in 2021 (+10 per cent over 2016) in contrast to the overall evolution of traditional market segments.

Traditional players brought in 56 per cent of the incremental revenues delivered by the top 100 groups over the same period. However, the growth of the top 100 players was largely driven by the pure SVoD players, namely Netflix, Amazon, DAZN and Apple. Their cumulated revenues grew by a factor of 6 between 2016 and 2021 and accounted for 44 per cent of the growth of the top 100 players.

The top 20 players consistently represented 71 per cent of the top 100 revenue figures over the same period analysed. Public players (PSBs) showed development under the average growth rate of the top 100 audiovisual companies and in 2021 saw their weight diminish by 3 per cent compared with 2016, and consequently their market share drop to 30 per cent in 2021.

The weight of US interests in the top 100 revenues increased in 2021 (by +3 per cent over 2016, up to a 30 per cent market share at the end of 2021) mainly due to the rise of the pure SVoD players but also of the SVoD services of US-backed broadcasters such as Sky, Paramount+ and Disney+. US players tend to start prioritising expansion through direct investments by launching SVoD platforms, acquiring European assets and producing content locally as opposed to traditional indirect investments.

M&A

Although the evolution was mainly due to organic growth, players also engaged in consolidations and divestments to bolster their revenues by creating better market propositions, scaling costs, or minimising losses. These market moves surged between 2021 and mid-2022, driven by telco players and were concentrated in the CEE region. These moves were generally designed to expand business to new territories or even access complementary market segments, to obtain premium content at competitive prices, to pair the content with strong distribution, to optimise window exploitation, to build strong convergent telco offers, to increase footprint, to gain market share, to better compete in the streaming war, or to streamline their activities and focus on strongholds. It was also a period in which the emergent trend of investments made in the audiovisual sector by equity funds, investors and ICT players, as well as by the AV industry outside Europe became more visible.

While active in several AV market segments at the same time, most of the top 100 AV companies in Europe by operating AV revenues appear to be driven by one leading activity, making the top 100 heterogeneous as regards their portfolio. Besides the particularity of their core business, the top players are also highly eclectic with regards to their internationalisation model, expansion strategy geographical focus, level of territorial coverage and expansion strategy.

Pay-AV services

SVoD stands out as the most concentrated audiovisual market segment in Europe, followed by pay-TV. At the end of 2021, a total of 71 per cent SVoD subscriptions were cumulatively taken out by subscribers to the top 3 OTT platforms (i.e. Netflix, Prime Video and Disney+), while 76 per cent of pay-TV subscriptions were cumulated by top 20 pay-TV operators.

The pay AV subscriptions (pay-TV and SVoD) cumulated in 2021 by top pay-AV service players owning at least one prominent pay-TV channel or SVoD platform show an interesting fact. Indeed one can deduce that the interests of European-owned groups are driven by a very different profile than US-backed groups in Europe.

Broadcasters of prominent pay-TV channels accounted for over 80 per cent of the European share of cumulated pay AV service subscriptions. Contrary to pure SVoD players in general, European-backed broadcasters tend to also be active in the pay-TV segment from which they gain on average half of their cumulated subscriptions to pay-AV services.

Conversely, pure SVoD platforms are driving 70 per cent of the US share of pay-AV service subscriptions, with the remaining subscriptions cumulated by the US majors and US-backed European broadcasters.

This report was authored by Laura Ene, Analyst within the Observatory’s Department for Market Information.