Survey: Consumers want bundles with more than just video

May 17, 2024

Twice a year, Hub’s Battle Royale survey explores US consumers’ entertainment choices and behaviour across categories: premium video, social video, gaming, music, reading, podcasts and more.

The latest wave of the study revealed new information about consumers’ taste for bundles, and the companies that are best positioned to offer them.

Key findings from the Battle Royale – Wave 5 study include:

1) TV is no longer the centre of the entertainment universe.

The entertainment ecosystem has expanded and today, TV is just one of many kinds of content people consume.

- Consumers in general use just as many non-video entertainment providers (6.6) as they do premium video (6.3).

- And young people (under 35) use more non-video sources (9.1) than video (7.4).

2) So, it’s no surprise that consumers’ ideal bundle includes more than just video.

In the survey, respondents saw a list of 16 items and were asked to choose five to build an ‘ideal’ bundle. The list included SVoDs, MVPD/VMVPD network packages, streaming music and gaming subscriptions, and non-entertainment items like mobile phone or home internet. Only two of the 5 most chosen items were video-related.

- 71 per cent of respondents included high speed internet in their bundle, and 52 per cent chose a mobile phone plan. (Another 40 per cent chose a live TV bundle, forming a new iteration of cable’s ‘triple play’)

- 65 per cent chose Netflix – the only streaming platform to make it into the top 5.

- 43 per cent chose a streaming music subscription. Respondents were more likely to choose streaming music for their bundle than major streaming platforms like Hulu, Disney+ and Max.

3) Consumers are ready to get an entertainment bundle from Netflix.

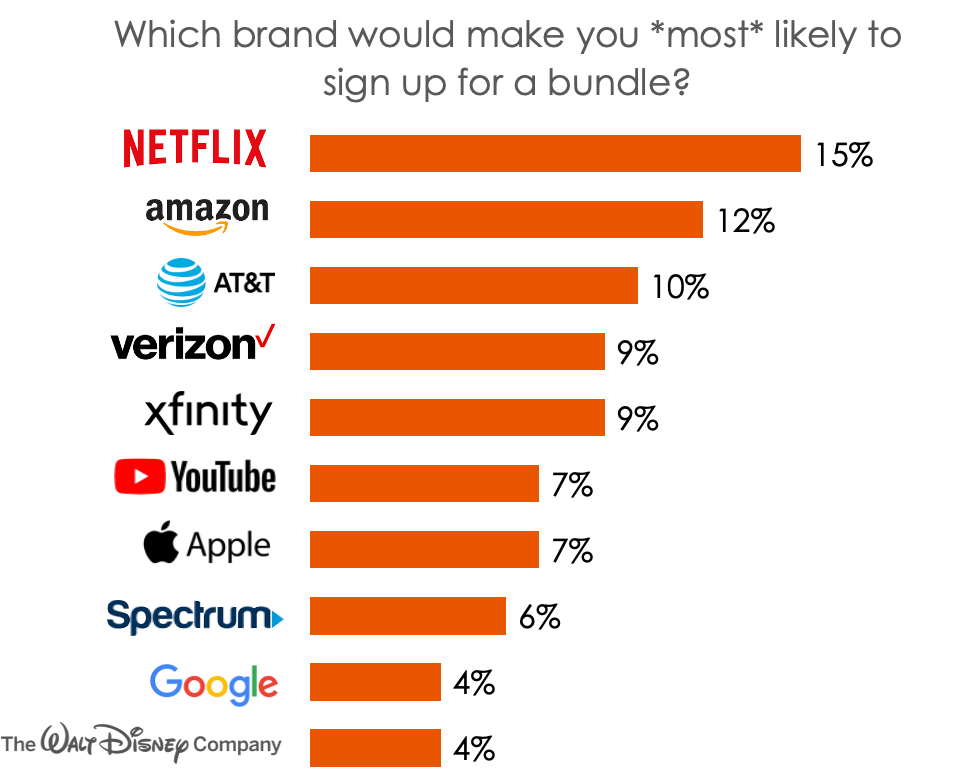

Finally, we showed respondents a list of 19 brands that might offer that ideal bundle and asked which company would make them most likely to sign up.

- Respondents were most likely to choose a bundle offered by Netflix (15 per cent) or Amazon (12 per cent) – two to three times more than those who chose other ‘big tech’ companies like Apple or Google.

- One third (34 per cent) chose one of the telco or cable aggregators (AT&T, Verizon, Xfinity or Spectrum).

“In the past, content like video, gaming, or music were entirely separate. Today, they are all consumed on the same screens and devices, via subscriptions that compete for the same pie of disposable time and money,” said Jon Giegengack, Hub Principal and Founder. “This research underscores the opportunity for established aggregators like Amazon or AT&T to attract [subscribers] with bundles that cross content categories. But it also shows that consumers would readily accept Netflix as an aggregator based entirely on the strength of its brand — something that bodes well for their expansion into live TV and gaming.”

The data cited here come from Wave 5 of Hub’s Battle Royale study, conducted among 3,000 US consumers who are entertainment decision-makers with broadband, age 18-74. The data was collected in March 2024.

Other posts by :

- Morgan Stanley downgrades Iridium

- SpainSat-NG II a total loss

- SES warns of risks for airlines adopting Starlink

- Starlink facing backlash in South Africa

- China wants 200,000 satellites

- Bank raises view on AST to $100

- Frost & Sullivan cites Hughes as #1

- Verizon cutting prices

- ScotiaBank confuses market over AST SpaceMobile