Liberty Global publishes Telenet offer

June 7, 2023

Liberty Global has announced the publication of the prospectus related to the voluntary and conditional public takeover bid by its indirect wholly-owned subsidiary, Liberty Global Belgium, for all the shares of Telenet that Liberty Global Belgium does not already own or that are not held by Telenet.

In conjunction with the prospectus, the Board of Directors of Telenet has prepared a response memorandum in which it sets out its recommendation of the Offer. Both the prospectus and the response memorandum have been approved by the Financial Services and Markets Authority in Belgium (FSMA). The FSMA’s approval does not imply any opinion by the FSMA on the merits or the quality of the Offer.

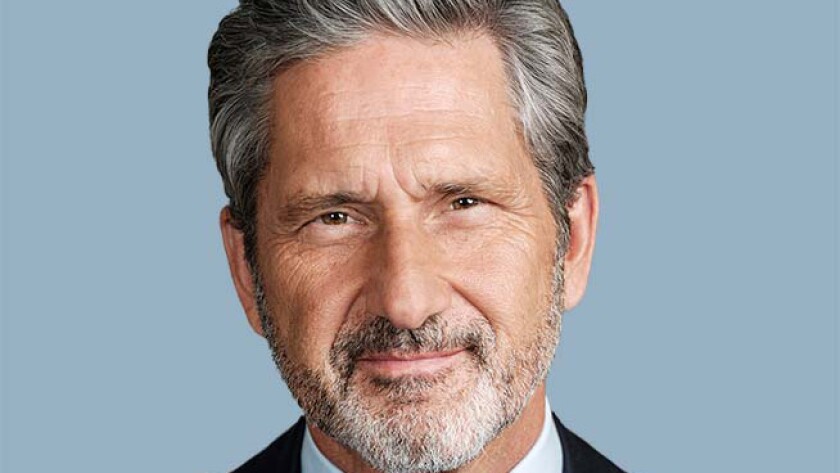

Mike Fries, CEO, Liberty Global, commented: “We are pleased to announce the approval of our Offer prospectus. Telenet shareholders can start tendering their shares on June 8, 2023 at an attractive premium. We are committed to maintaining Telenet’s status as a leading and pioneering telecommunications and entertainment company in Belgium.”

Telenet’s Board of Directors unanimously supports and recommends the Offer, as confirmed in the statement Telenet issued today. The Telenet Board of Directors has provided its formal opinion in a response memorandum published today.

The Offer is an offer in cash at a price of €22 per share, deducting the €1 gross dividend approved by Telenet’s ordinary general meeting of April 26th as paid on May 5th. This results in an Offer price of €21.00 per share . The Offer is subject to the conditions that, (i) as a result of the Offer, Liberty Global Belgium Holding must, together with Telenet, own at least 95 per cent of the shares in Telenet and (ii) no material adverse change occurs with respect to the closing quote of the BEL-20 index and/or shares of Proximus NV/SA and Orange Belgium NV/SA prior to the date of the announcement of the results of the Offer (subject, in the case of Proximus NV/SA, to an adjustment to take into account a dividend payment of €0.70 per share on April 28th). This adjustment clarifies the terms of the Offer set forth in the notification published by the FSMA in accordance with Article 7 of the Royal Decree of April 27th on public takeover bids, which otherwise remain the same and therefore does not reflect a material change in the terms of the Offer or the economics of the Offer.

The initial acceptance period will start today (June 8th) and end on July 12th at 4 pm CET (unless extended). Liberty Global intends to announce the results of the initial acceptance period on or around July 19th. The Offer Price will be made payable on July 26th, assuming no mandatory extensions of the Offer.

During the initial acceptance period, shareholders can tender their shares to the Offer by following the instructions set out in the prospectus.

If, following the Offer, Liberty Global Belgium Holding, together with Telenet, own at least 95 per cent of the shares of Telenet and have acquired, by acceptance of the Offer, at least 90 per cent of the shares that are the subject of the Offer, the Offer will be followed by a simplified squeeze-out bid subject to the same financial conditions as the Offer.