Disney invests $1.5bn in Epic Games; streamer sheds 1.3m

February 8, 2024

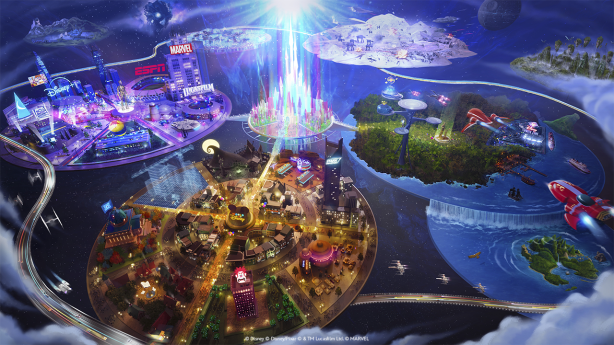

The Walt Disney Company and Fortnite maker Epic Games have announced they will collaborate on all-new games and an entertainment universe. Disney will also invest $1.5 billion (€1.39bn) to acquire an equity stake in Epic Games alongside the multiyear project. The transaction is subject to customary closing conditions, including regulatory approvals.

In addition to interoperating with Fortnite, the new persistent universe will offer a number of opportunities for consumers to play, watch, shop and engage with content, characters and stories from Disney, Pixar, Marvel, Star Wars, Avatar and more. Players, gamers and fans will be able to create their own stories, express their fandom, and share content with each other. This will all be powered by Unreal Engine.

“Our exciting new relationship with Epic Games will bring together Disney’s beloved brands and franchises with the hugely popular Fortnite in a transformational new games and entertainment universe,” said Bob Iger, Disney CEO. “This marks Disney’s biggest entry ever into the world of games and offers significant opportunities for growth and expansion. We can’t wait for fans to experience the Disney stories and worlds they love in groundbreaking new ways.”

“Disney was one of the first companies to believe in the potential of bringing their worlds together with ours in Fortnite, and they use Unreal Engine across their portfolio,” said Tim Sweeney, CEO and Founder, Epic Games. “Now we’re collaborating on something entirely new to build a persistent, open and interoperable ecosystem that will bring together the Disney and Fortnite communities.”

“This will enable us to bring together our incredible collection of stories and experiences from across the company for a broad audience in ways we have only dreamed of before,” added Josh D’Amaro, Chairman, Disney Experiences. “Epic Games’ industry-leading technology and Fortnite’s open ecosystem will help us reach consumers where they are so they can engage with Disney in the ways that are most relevant to them.”

Additionally, Disney announced that its Q1 revenues were comparable to the prior-year quarter at $23.5 billion.

Hulu subscribers increased by 1.2 million from the prior quarter. Disney+ Core subscribers decreased sequentially by 1.3 million but the company saw a rise in average revenue per user (ARPU) as a result of subscription cost hikes. Disney said it expects Disney+ Core subscriber net additions of between 5.5 and 6 million and ongoing positive momentum in ARPU in Q2.

Disney’s D2C unit reported a $138 million operating loss in Q1. Including the performance at ESPN+, losses for all its streaming businesses narrowed to $216 million from $1.05 billion in the prior-year quarter.

“Just one year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation,” said Iger. “Our strong performance this past quarter demonstrates we have turned the corner and entered a new era for our company, focused on fortifying ESPN for the future, building streaming into a profitable growth business, reinvigorating our film studios, and turbocharging growth in our parks and experiences. As we build for the future, the steps we are taking today lend themselves to solidifying Disney’s place as the preeminent creator of global content. Looking at the renewed strength of all of our businesses this quarter – from Sports, to Entertainment, to Experiences – we believe the stage is now set for significant growth and success, including ample opportunity to increase shareholder returns as our earnings and free cash flow continue to grow.”

In a busy news days for Disney, the company also announced that, starting this summer, Disney+ accounts suspected of password-sharing will be given the option to create their own subscription.

“Account holders who want to allow access to individuals from outside their household will be able to add them to their accounts for an additional fee,” said CFO Hugh Johnston during a financial call. “We want to reach as large an audience as possible with our outstanding content. And we’re looking forward to rolling out this new functionality to improve the overall customer experience and grow our subscriber base.”

Wary of activist investors pushing for a break up, Disney used the improved results to bring forward a 50% dividend uplift and $3bn stock buyback. Iger called the results a turning point as he predicted the company would achieve its target of $7.5bn cost cuts over the year.