UK government loses £200m on OneWeb stake

January 2, 2024

By Chris Forrester

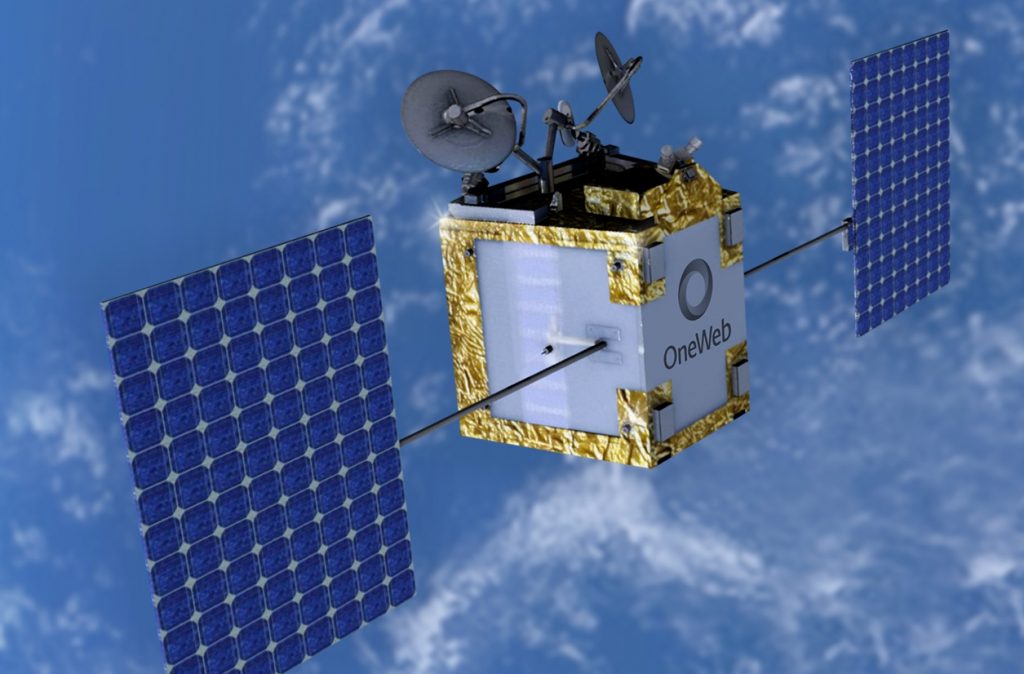

The merger between Eutelsat and constellation operator OneWeb has cost the UK taxpayer around £200 million (€230.9m) in losses.

The unexpected decision to rescue OneWeb from bankruptcy was driven, at least in part, by anxieties that China could gain control of the struggling business. Dominic Cummings, a key adviser to the now disgraced former Prime Minister Boris Johnson at the time, played a role in the surprise bailout.

In 2020 the UK government invested some £400 million into OneWeb (with India’s Bharti putting in a similar amount). Since the investment was made Eutelsat’s share price has tumbled and now means that the value of the combined Eutlesat+OneWeb business is worth less than half that initial investment. Analysts suggest the stake is now worth some £195 million.

More recently Fitch Ratings has downgraded Eutelsat’s debt, while some investment banks have themselves downgraded their opinion on prospects for the business. Fitch analysts downgraded Eutelsat’s debt ratings, warning that the company now faces “significantly increased performance and free cash flow risks” following the merger.

The UK stake in Eutelsat+OneWeb is 11 per cent and gives the British government a seat on the Eutelsat board of directors.

Many observers compare OneWeb with Elon Musk’s Starlink broadband-by-satellite service. The two businesses could not be more different. Other than both enterprises use satellites, Musk’s targets consumers around the world as well as businesses, airliners and cruise ships. OneWeb is targeting business and enterprise users as well as schools and other larger-scale centres for data usage, but has no plans for any direct-to-consumer service..

Eutelsat’s market capitalisation is now less than €2 billion, while Musk’s Starlink has been given a value of around $180 billion.