Satellites share prices still disappoint bank

January 17, 2024

Investment bank BNPP, in a major examination of three key satellite operators and their share prices, says SES, Eutelsat and Telesat have remained under pressure – with only Telesat making some modest headway because of its progress with its Lightspeed low Earth orbit constellation.

In a self-examination of what it got right (and wrong) in 2023 the bank asked whether new offerings from the two main European-based operators could drive a return to positive revenue growth.

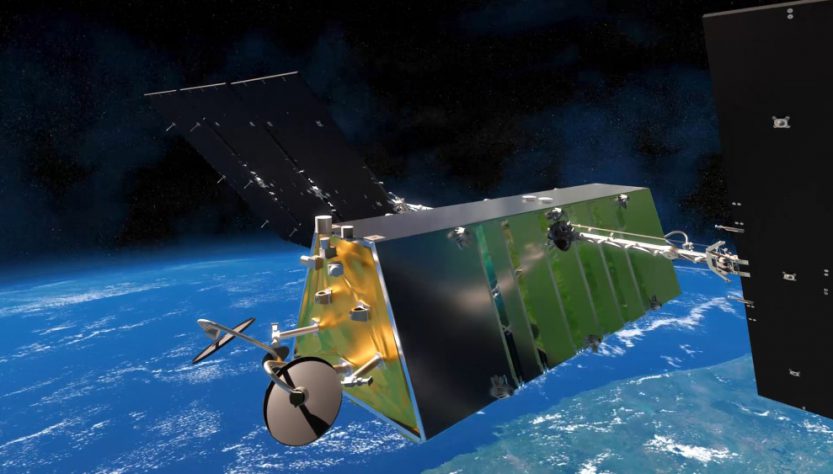

For SES that aim is all about its new mPOWER medium Earth orbiting satellites, which are late to join the fleet.

“The entry into service of SES’s mPOWER craft has been delayed to 2024 but the required satellites have now been launched. SES revealed major technical issues had caused the delay. SES has replaced its CEO,” says BNPP’s satellite analyst Sami Kassab.

There’s also an overall challenge for all geostationary satellite operators, says the report. They are all suffering a decline in what used to be ‘cash cow’ Video/DTH revenues and are now pivoting to Network applications.

The bank adds that its industry sector tracking over recent quarters have seen volume demand trends improving for SES (at its 19.2 main European orbital position), “while they have worsened for Eutelsat”.

Eutelsat is busy absorbing its merger with LEO operator OneWeb, but has suffered a debt downgrading to below investment grade.

The bank reminds clients that both SES and Eutelsat are hopeful of a positive return to group revenue growth in their Network divisions but competitive pricing is forcing prices down.

The bank says it continues to favour SES “as the player offering the most competitive bandwidth economics. The bank sees a stabilisation of group revenues for both SES and Eutelsat this year, and a return to positive growth in 2025 for both companies. “However, numerous false starts in the past and increasing competition (Amazon Kuiper, Telesat, Chinese operators) lead us to accept that the risks to our forecasts are high.”

It adds that the SES balance sheet (helped by last year’s $3 billion FCC payment to SES) is in a much stronger position.

Other posts by Chris Forrester:

- Intelsat C-band ‘insider trading’ case dismissed

- UK Space Agency funds de-orbit scheme for OneWeb

- AST SpaceMobile to launch satellites in August

- SpaceRISE silent on reports of demise

- Project Kuiper seeks India licence

- FAA suspends SpaceX launches

- SpaceX vs AST SpaceMobile

- Eumetsat explains Ariane 6 cancellation

- AST SpaceMobile examines emergency call obligations