Forbes: “2024 the year of LEO”

January 30, 2024

By Chris Forrester

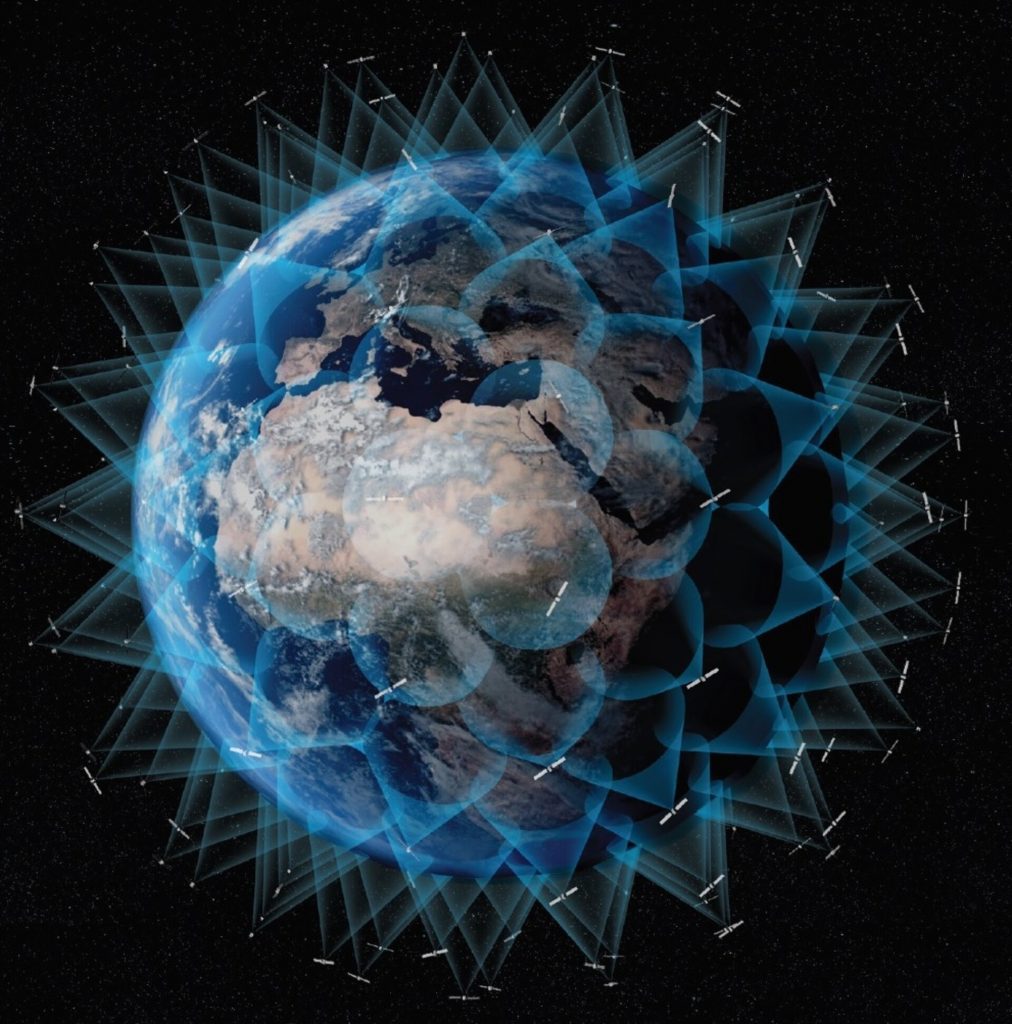

Forbes has declared that 2024 will be the ‘Year of Low Earth Orbit satellite services’ and expects the likes of Elon Musk’s Starlink to make significant inroads but with competition from other players. That competition could make the LEO segment a “crowded place”.

February will see Mobile World Congress take place in Barcelona where satellite-based connectivity will discuss 5G and the demands for 6G spectrum and the inevitable consequence for – if nothing else – backhaul services. All the major satellite operators are present including SES and Eutelsat/OneWeb.

Notwithstanding the likes of SES and Eutelsat/OneWeb (and Amazon’s Project Kuiper LEO system and Apple’s existing SMS emergency services) Forbes says that this year’s LEO field will be dominated by Starlink, and AST SpaceMobile which made considerable headlines last week with significant injections of cash from Vodafone, Google and AT&T.

“In practical terms, leadership in this field has narrowed down to two players that have the potential to truly bridge the global digital divide,” suggests Forbes and contributor Will Townsend, a networking and security analyst.

Starlink is promising a global satellite-to-smartphone services later this year. Initially with SMS and emergency connectivity with the likes of T-Mobile, Rogers in Canada and KDDI in Japan. “Starlink is making tangible progress in its promise to bring satellite connectivity to standard, unmodified terrestrial handsets and devices, but, again, this testing is only beginning,” states Forbes.

AST SpaceMobile is busy in the test phase of its LEO satellite direct-to-smartphone service since the successful deployment of its BlueWalker 3 prototype satellite on November 10th 2022. AST’s new cash cements its potential to add new satellites later this year and during 2025. Forbes suggests that AST’s fresh cash could accelerate AT&T’s time-to-market and the eventual monetisation tied to satellite-to-terrestrial connectivity. Google’s involvement as a technology behemoth has to have a considerable potential impact for AST.

It is the same for Vodafone. “Vodafone Group [will] cement its opportunities to extend coverage in Europe, Asia, Oceania and Africa. Countries such as Australia that have large, remote expanses of land will benefit tremendously from LEO satellite coverage – and will do so without needing costly incremental equipment that would be a tough sell in many developing market regions such as Africa,” says the magazine.

Starlink has more than 5,000 working LEO satellites in orbit, and has telephony in its sights. AST SpaceMobile is just starting its journey, but having the likes of AT&T, Vodafone and Google in its armoury makes a powerful set of foundations for a business that should rapidly move from test to commercial introduction.