Eutelsat extends life of OneWeb satellites

February 19, 2024

By Chris Forrester

Eutelsat’s CEO Eva Berneke, in a post-results Q&A with analysts on February 16th, said that she expected its Video DTH decline to slow. Revenues from Video – mostly DTH – had fallen 8 per cent during the 6-months to December 31st 2023. The loss was not helped by DigiTurk not renewing its contract with Eutelsat as well as EU-demanded bans on carrying Russian and Iranian channels. Berneke said she expected the decline to continue but at a much slower pace (4-6 per cent) over the current half year to June 30th.

Video in the past was key to Eutelsat’s health but now represented 58 per cent of revenue and falling, so by the end of this financial year (June 30th) it is likely to be nearer 46 per cent of revenues.

The gap has been made up with buoyant revenue growth from its Mobile (up 35.6 per cent), Connectivity (up 9.2 per cent and Government (up 10.5 per cent) divisions.

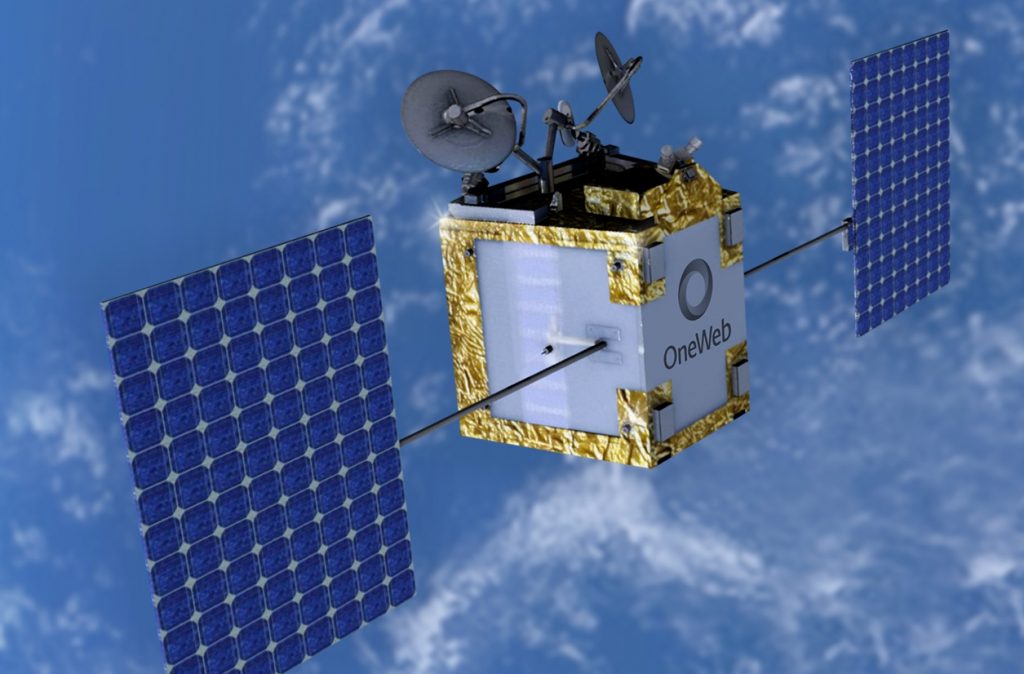

She also made a major statement on Eutelsat’s recently acquired OneWeb business. Berneke explained the appeal of OneWeb, saying: “[Which] combines a legacy cash-generative GEO business with a high-growth activity in LEO that generates strong revenue growth. We’re accessing a massive and still growing satellite connectivity market where the majority of growth is going to come out of the non-GEO part of the segments.”

OneWeb has only been part of Eutelsat for a little over three months (in terms of the half-year numbers) and she said that it was now clear that with a “less than 1 per cent” failure rate of the OneWeb fleet of 648 satellites and allowed a rethink on the plans for Second Generation satellites for OneWeb. Eutelsat will now go a little slower on building and launching these Gen 2 craft while extending the life of the current fleet, thus saving and spreading out it CapEx although the new versions will be more powerful. The earlier plan was for around 300 of these new versions, but with 3 to 5-times the capacity and an overall bill of around €4 billion for the replacement costs.

Eutelsat now says that it can trim around 30 percent from this anticipated expenditure and that the replacements will be phased in gradually. It has fresh finance available from the UK Export Fund, France’s BPI and Export Credit Guarantee Corporation of India Ltd (ECGC).

While not specified it is expected that India would win the launch tasks for a number of these Gen 2 satellites. What was specified was that the Gen 2 satellites would be uprated to include new features such as much higher throughput and optical (laser) inter-satellite capabilities.

Berneke also talked about the EU’s IRIS2 (broadband satellite) consortium of which it is a part (along with SES, Thales, Hispasat and others). She said that development of satellite technologies under the IRIS2 public-private partnership would be useful to OneWeb’s Gen 2 to help de-risk the new constellation.

However, currently Eutelsat/OneWeb has it hands tied in reaching and serving some of its target markets and these delays are not helping its business. It has just 30 of the key ‘gateway’ ground stations in operation (out of a minimum planned 43) and some markets are slow to grant the necessary licences. “A few countries have taken a bit of time approving [licenses] because they needed to understand what LEO is all about,” Berneke said. “So, the ground network and market access are the hoops you need to jump through once you have the satellites in place.

She said that OneWeb was now operating for 54 countries, adding: “But landing rights are still pending, as in some African countries. Some countries, like Saudi Arabia, are still missing a gateway, they need one more gateway to open up fully.”