Report: Mobile connectivity programme behind schedule

February 22, 2024

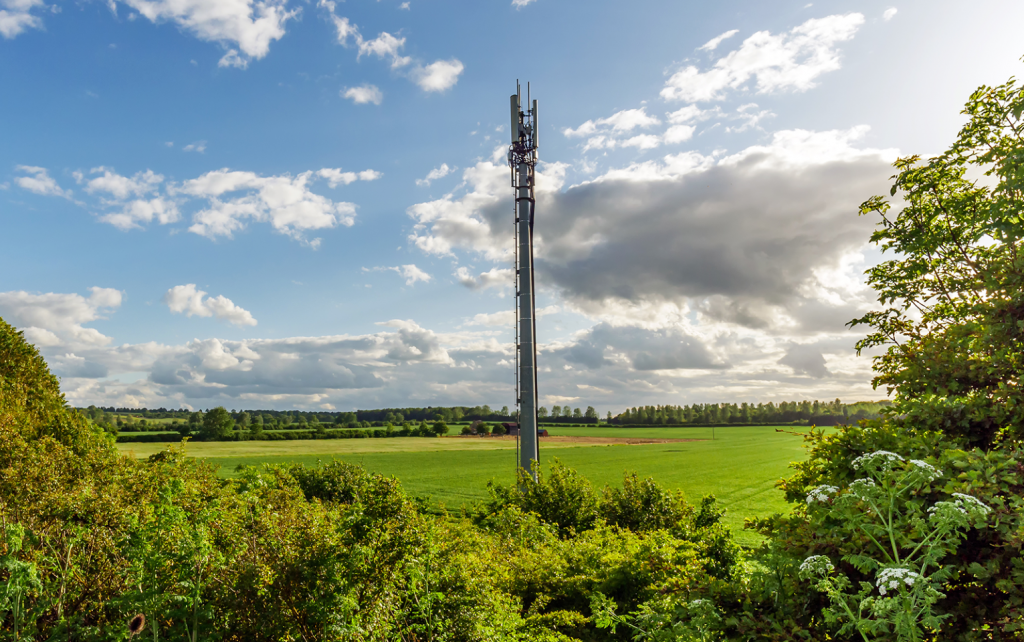

The UK government’s plans to extend 4G mobile connectivity and broaden consumer choice in rural areas are behind schedule, according to a National Audit Office (NAO) report.

Launched in March 2020, the Shared Rural Network (SRN) is a joint programme funded by the Department for Science, Innovation and Technology (DSIT) and the UK’s four mobile network operators (MNOs): EE, Three, Virgin Media, O2 and Vodafone. Government considers access to good quality mobile connectivity key to growing the UK economy.

The SRN aims to achieve 95 per cent 4G mobile coverage across the UK landmass by December 2025 – up from 91.4 per cent when the programme launched in March 2020. By autumn 2023, 92.7 per cent of UK landmass had 4G coverage, but the programme was behind schedule, with only EE announcing that it had met its interim coverage target. It is not yet clear whether the programme will meet its 95 per cent target on time.

Reasons for delay vary. Government and the MNOs took longer than expected to finalise mast locations, agree site sharing and access, and procure services. Progress on the programme has also been delayed by the pandemic, opposition from local campaign groups and local authorities’ capacity to handle planning applications.

Estimated costs have risen significantly on the programme, due to high inflation and other factors, although government does not yet know by how much in total.

As a result of cost pressures, MNOs may no longer be able to deliver the level of coverage required within the current funding, which includes £501 million of government funding, and £532 million of private sector funding – £1.033 billion in total.

Under the terms of their grant agreement with the government, MNOs bear any additional costs. However, if costs are excessive, MNOs may not be obliged to meet individual targets, further risking the overall ambition to achieve 95 per cent mobile coverage across the UK landmass.

DSIT’s business case suggests the investment will deliver economic benefits of £1.352 billion through supporting tourism and business productivity in rural areas. However, the business case included limited evidence of the specific benefits of extending mobile coverage into remote or sparsely populated areas.

Ofcom requires MNOs to meet a minimum download speed of 2 Mbps (megabits per second). DSIT anticipates an average download speed of 7 Mbps for rural areas, though the Department acknowledges some areas will have lower download speeds. DSIT expects these lower speeds to meet current needs but recognises that advances in technology could lead to people requiring higher performance in the future, meaning the network may need upgrades.

The government’s plans for future mobile connectivity are outlined in DSIT’s 2023 Wireless Infrastructure Strategy, which was welcomed by MNOs and other stakeholders. The strategy aims to kick-start investment and innovation in 5G infrastructure and sets a new ambition for standalone 5G in all populated areas by 2030. DSIT estimates that widespread UK adoption of standalone 5G could deliver cumulative productivity benefits of between £41 billion and £159 billion from 2021 to 2035. Since 2017, DSIT has committed around £400 million to initiatives to determine how 5G can be used and to promote its adoption.

Achieving the 5G coverage ambition will be challenging. It will require significant investment from MNOs and DSIT will be reliant on accompanying action from other government departments and bodies that may have competing priorities for funding. DSIT will also need to draw on its experience from previous infrastructure programmes, including the SRN, to help it address these issues.

The NAO recommends improved oversight of MNOs on the SRN programme to enable effective decision making and sufficient focus on delivering the 4G performance for consumers and businesses.

On 5G, DSIT’s Wireless Infrastructure Strategy should establish target dates for taking key decisions about the outcomes it is seeking; determine the combination of enablers required to deliver 5G connectivity; collect data on the market’s ability to meet the UK’s future 5G connectivity needs; and learn lessons from delivering earlier digital infrastructure.

Gareth Davies, head of the NAO, commented: “Demand for mobile data access is expected to increase as data-intensive services become more popular and new technologies enable new uses, and government has set out a clear ambition for improved connectivity. It is unclear whether the Shared Rural Network programme will achieve its coverage target on time; costs are higher than anticipated; and government has not clearly articulated the benefits of aspects of the programme, including increased connectivity in sparsely populated areas. As government develops its 5G strategy, it will need to more clearly define what it is aiming to achieve in different parts of the UK and economic sectors, so that limited resources can be targeted where they deliver most value.”