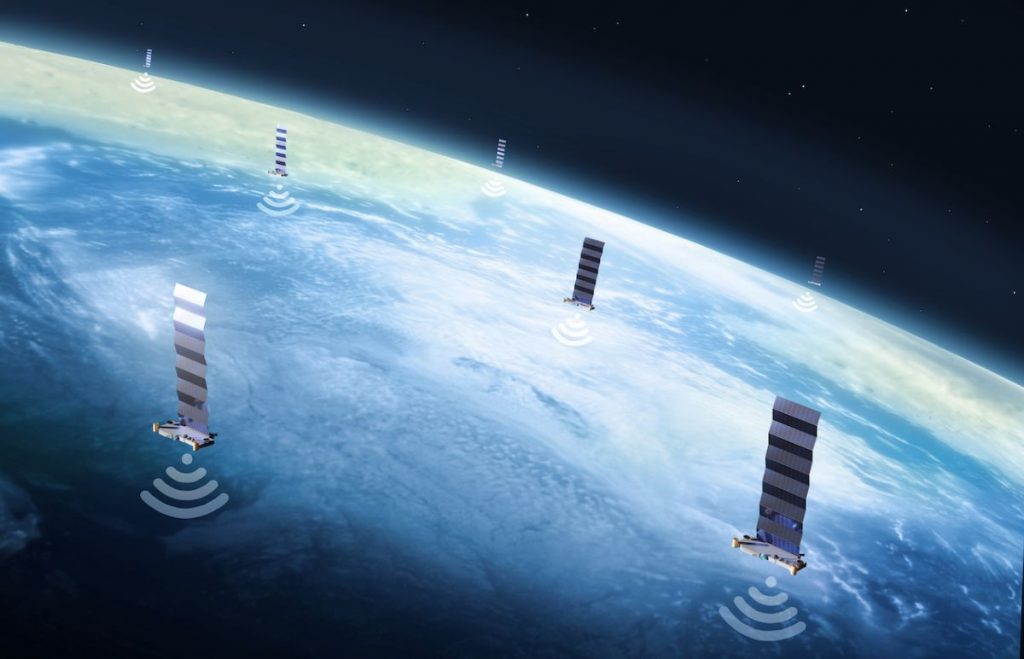

Analyst: Starlink progress exceeding expectations

May 14, 2024

Analysts from Quilty Space say that Starlink’s progress is exceeding expectations and will generate a $6.6 billion (€6.1bn) in revenues in 2024.

“Back in 2015, when SpaceX and OneWeb announced these mega-constellations, many industry veterans scoffed,” said Chris Quilty, founder of Quilty Space. “They remembered past satellite broadband ventures failing in the 1990s.”

Quilty’s failing ventures were many, not least the first Iridium scheme (now rescued from bankruptcy and doing well); Teledesic which despite being backed by billionaires Craig McCaw and Bill Gates went bust in 2002; Alcatel’s Skybridge which was a $6 billion satellite broadband project and went bust in 2002; Globalstar (now best called ‘old Globalstar’) filed for bankruptcy in 2002. The restructured business has 48 satellites in orbit and is now helped by Apple.

That we are now in a new age for satellite-based communications and broadband is undoubted. Quilty’s analysis suggests that Starlink’s revenues will grow from $1.4 billion back in 2022 to $6.6 billion this year. “We expect Starlink to achieve positive free cash flow for the first time in 2024,” said Quilty, and this year will see SpaceX become self-sustaining.

Chris Quilty took Starlink’s $6.6 billion growth and compared it to the now merging SES and Intelsat projected revenue of just over $4 billion. And these two businesses are very long-established.

While growth in revenue and subscribers seem guaranteed so is the cost of each satellite. Starlink Version 1 craft cost about $200,000 each. The current V2 craft are costing nearer $800,000 each while a future V3 craft will cost around $1.2 million, says Quilty.

“By controlling a large portion of the manufacturing process in-house, SpaceX avoids profit margins typically added by external suppliers, keeping costs down,” explained Quilty’s research boss Caleb Henry.

Additionally, SpaceX has established an unprecedented production cadence, churning out satellites at a rate unseen before in the industry and thus lower production costs because of the high volumes exiting Starlink’s factory.

“By targeting consumers first, primarily via a direct-to-consumer sales model, Starlink was able to scale at an unprecedented pace for a satellite operator. Starlink is now evolving and expanding its strategy for enterprise, mobility, and government end markets,” the report added.

“We’re keeping our eye on two more countries, specifically India and Indonesia, which have large population centers but have not yet licensed Starlink,” Henry said. “Those are future needle-movers for the constellation.”

Other posts by Chris Forrester:

- Intelsat C-band ‘insider trading’ case dismissed

- UK Space Agency funds de-orbit scheme for OneWeb

- AST SpaceMobile to launch satellites in August

- SpaceRISE silent on reports of demise

- Project Kuiper seeks India licence

- FAA suspends SpaceX launches

- SpaceX vs AST SpaceMobile

- Eumetsat explains Ariane 6 cancellation

- AST SpaceMobile examines emergency call obligations