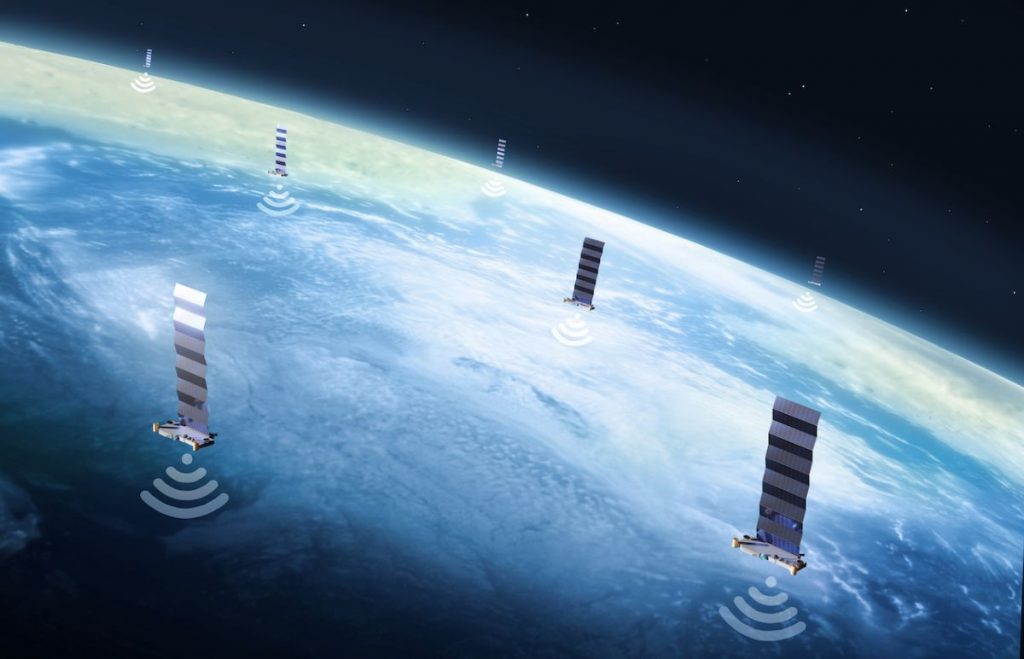

Report: D2D a big opportunity for Starlink

February 7, 2023

Elon Musk’s Starlink is well on its way to completing its first tier of 4,000 low Earth orbiting satellites. Recent data shows that 3,875 craft have been launched (including some Gen-2 versions), although not all reached orbit.

Nevertheless, a report from Tim Farrar of TMF Associates suggests that Musk’s SpaceX is targeting a new business despite already securing private and commercial broadband users as well as military, aircraft and shipping and even RV owners.

Farrar says: “There’s been plenty of hype about the Direct-to-Device (D2D) market for satellite to smartphone connectivity in the last couple of years, and that has only intensified in the wake of recent announcements about Apple’s partnership with Globalstar and Qualcomm’s partnership with Iridium. Some analysts have even gone so far as to suggest that D2D represents the ‘largest opportunity in Satcom’s history’”.

He adds that a move into D2D represents “significant” technical challenges although identifies the recent Apple+Globalstar agreement cost Apple little more than $100 million per year and is capable of “billions of messages per year”.

“Nevertheless, D2D is becoming the next opportunity that SpaceX can hype, beyond its core fixed broadband market, as it looks for additional increases in the company’s valuation so it can keep raising money to keep developing Starship, while putting even more distance between Starlink and broadband competitors like OneWeb and Kuiper. And just as SpaceX has scared away potential investors in nascent LEO broadband systems like Telesat’s Lightspeed, we expect SpaceX to crowd out many of the other players in the D2D market, now that funding for speculative space projects is becoming more scarce,” Farrar states.

Farrar says that SpaceX could kill off a number of rivals (and mentions AST, Lynk and Omnispace). “Our conclusion is that while D2D messaging is likely to deliver meaningful upside for existing Mobile Satellite Services networks like Globalstar and Iridium, it will be much more difficult to gain global consensus on use of terrestrial spectrum. As a result, SpaceX is likely to hedge its bets and pursue a twin-track strategy of seeking access to both terrestrial and satellite spectrum, and potentially follow up its 2021 acquisition of Swarm with further deals to buy satellite operators and their spectrum licenses.”

Farrar even suggests that the market might even see a SpaceX smartphone emerge, although stresses that the potential market size to remain far smaller than Starlink’s fixed broadband opportunity and it is not at all clear that it will be possible to make an economic return on these D2D investments.

Other posts by Chris Forrester:

- Intelsat C-band ‘insider trading’ case dismissed

- UK Space Agency funds de-orbit scheme for OneWeb

- AST SpaceMobile to launch satellites in August

- SpaceRISE silent on reports of demise

- Project Kuiper seeks India licence

- FAA suspends SpaceX launches

- SpaceX vs AST SpaceMobile

- Eumetsat explains Ariane 6 cancellation

- AST SpaceMobile examines emergency call obligations