Report: Pay-TV penetration peaks

November 21, 2023

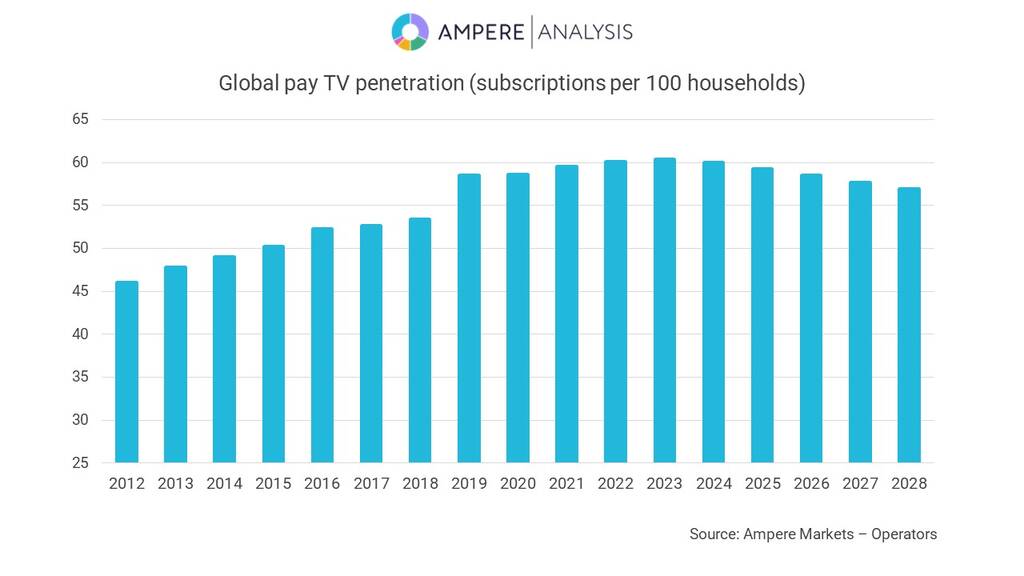

Global pay-TV penetration will see its first-ever yearly decline in 2024, according to research by Ampere Analysis. The drop will follow pay-TV penetration peaking at 60.3 per cent in Q4 2023 according to the research, which forecasts that by 2028 global pay-TV penetration will have fallen by almost four percentage points.

In North America, pay-TV penetration has almost halved from a high of 84 per cent in 2009 to 45 per cent in 2023, which Ampere Analysis attributes ti a combination of high costs and competition from a mature SVoD market. Despite this decline, the annual revenue generated per user (RGPU) will sit at over $1,100 (€1,000.52) in 2023 across North America, the highest across any region.

Latin America has also shown significant declines in penetration since 2016. This is mainly driven by Brazil, which has posted a drop of around 10 percentage points since its peak pay-TV penetration of 42 per cent in 2016. Furthermore, although North America and Latin America are driving this shift, Ampere Analysis predicts that all regions will be in pay-TV penetration decline by 2025.

Asia Pacific and Europe have seen the highest penetration growth in recent years, with large gains coming from China Mobile after it acquired an IPTV licence in 2018. This growth has been driven by low-cost IPTV services, which are often bundled into broadband packages for a lower cost. While these regions will also fall into decline after 2025, there are still some growth markets, such as Portugal, Serbia and Hungary, which are expected to see further growth in the forecast period.

Rory Gooderick, senior analyst at Ampere Analysis commented: “Growth in global pay-TV uptake has been driven over the last five years by Asia Pacific and Central & Eastern Europe. However, declines coming from the Americas, which are driven by streaming competition and the high price of pay-TV in North America, currently sitting at over $90 a month, will contribute to global pay-TV penetration declining for the first time in 2024.”

“However, despite the projected decline in the reach of pay TV products, cable and satellite platforms will remain a powerful force in the TV world, and important distribution partners for streaming products, as evidenced by the recent distribution deal between Disney and Charter in the US, which saw select Disney streaming services bundled into Charter’s TV packages. This package structure, already increasingly common in Europe and parts of Asia, offers a framework for traditional cable TV companies to transition their business into a streaming aggregation play, and stabilise subscriber trajectories,” concluded Gooderick.