Forecast: 130m direct-to-phone satellite users by 2032

December 1, 2023

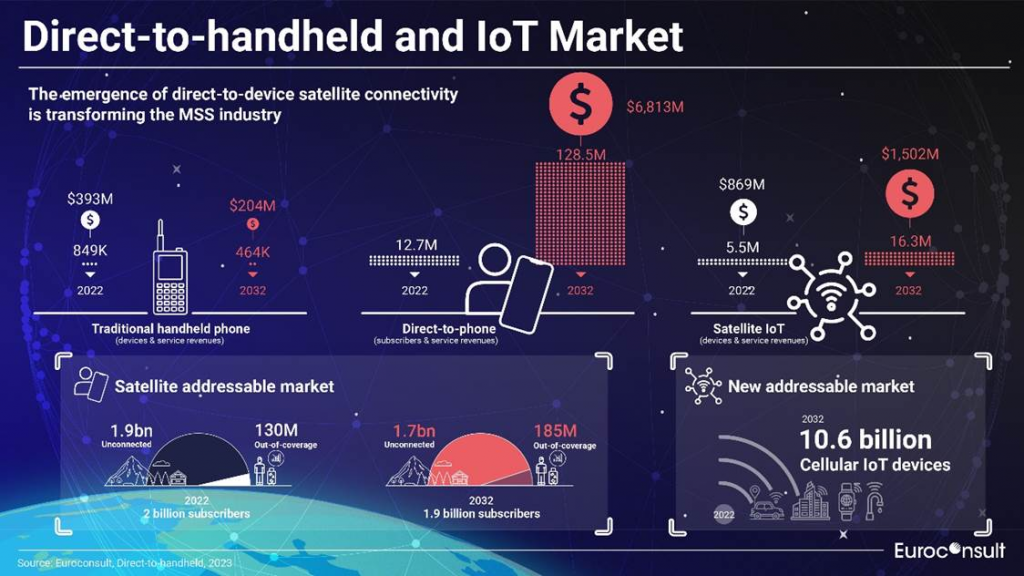

Euroconsult’s Prospects for Direct to Handheld and IoT Markets report unveils the developing potential of the satellite direct-to-device market, with projections indicating that direct-to-phone services could connect nearly 130 million average monthly users by 2032.

Euroconsult’s market intelligence report delves into the dynamic landscape of three crucial satellite communication market segments: traditional handheld phones, direct-to-phone connectivity, and Internet of Things (IoT). The report provides a new level of detailed analysis covering market developments, major applications, equipment solutions, and the growth drivers and challenges inherent to each segment.

Satellite cellular IoT is a niche market enabling hybrid solutions via in-market unmodified IoT devices with a high market potential due to the ease of implementation. Non-geostationary orbit (NGSO) satellite constellations are playing an increasingly pivotal role in creating new opportunities to seamlessly integrate satellite connectivity into existing devices.

This surge in direct-to-device satellite connectivity is also being fueled by advancements in the 3rd Generation Partnership Project 3GPP standards (specifically Release 17), facilitating the integration of terrestrial and non-terrestrial networks (NTN).

Consistent with a forecasted decline in market demand and the cannibalisation of competing services, Euroconsult’s report asserts that traditional handheld phone users will decline by nearly half, whilst the direct-to-phone market will see a rising user count by 2032 to around 130 million. In addition, IoT devices are expected to triple over the coming decade, largely due to the increased accessibility of satellite IoT solutions offered by new market entrants.

Addressing the potential ‘unconnected’ population, the direct-to-phone segment eyes a total satellite connectivity market of over 2 billion subscribers in 2022. This segment targets individuals without terrestrial network coverage (1.9 billion) and mobile users encountering connectivity issues due to poor terrestrial network coverage or travel to areas without coverage (130 million).

Expanding the market’s horizons further, the IoT segment is set to substantially increase its potential as a revenue-generating force with satellite cellular IoT, anticipated to commence revenue generation in 2025. Key applications expected to drive this growth include ‘connected cars’ in transport/logistics, ‘smart cities’ in natural resources (oil rigs, mining sites, utilities) and personal tracking assets like smartwatches. Projections forecast a substantial addressable market of 10.6 billion cellular IoT devices by 2032.

Sumaiya Najarali, Euroconsult senior consultant, commented: “Continuous technological improvements have bolstered satellite capacity and enhanced device capabilities, hastening the adoption of direct-to-device satellite services. Despite the strong prospects for the direct-to-handheld and IoT markets, success will be largely influenced by external factors, particularly securing spectrum rights and overcoming regulatory barriers, and internal forces, including funding initiatives to support planned satellite infrastructure and commitments from MNOs. Additionally, affordability of services and customer willingness to pay will be pivotal in this cost-sensitive market.”