Report: “Starlink most disruptive force in sat market”

December 19, 2023

By Chris Forrester

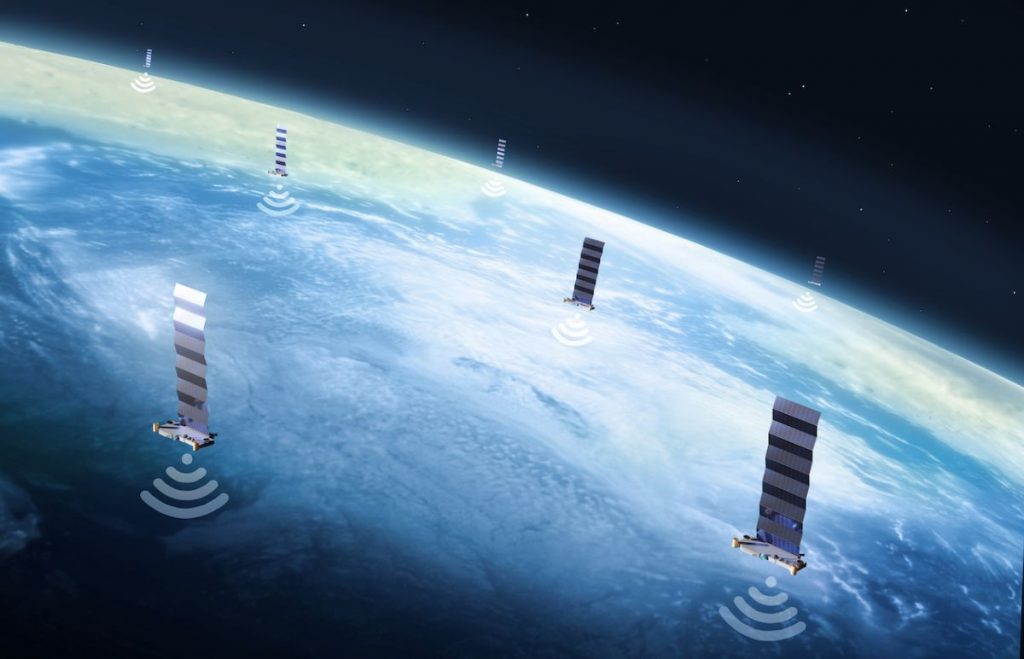

Starlink is busy counting down the days to the end of the month with observers speculating on whether it might reach a rumoured 100 launches for 2023. Either way, SpaceX and its Starlink division have achieved a spectacular 2023, and with 2024 launches of its giant Starship expected, the company can expect further intense media comment.

Northern Sky Research (NSR), in a report, describes SpaceX’s Starlink broadband-by-satellite service as “the most disruptive force in the satellite market today. No other actor in the value chain can match Starlink’s pace in terms of innovation, both from the technology and service standpoints.”

NSR is right. When the likes of London-based Avanti Communications talk freely of considering Starlink (although not confirmed) as its low Earth orbiting partner, the news for Starlink can only get better. It enjoys multiple opportunities touching just about every element of satellite usage, with more to come (Direct-to-device/cellular, new markets, boosted speeds/coverage).

NSR states: “The fact that Starlink operates from the low-Earth orbit (LEO) differentiates it from legacy geostationary-Earth orbit (GEO) actors. However, attributing its success solely to its operation from the LEO overlooks how disruptive and difficult it is to imitate Starlink’s business model. No other actor in the value chain can match Starlink’s pace in terms of innovation, both from the technology and service standpoints. For the traditional satellite communications value chain, embracing 5G concepts and standards are vital to accelerate the pace of innovation and, at the same time, unlock the $110.9 billion cumulative 5G satellite service revenue opportunity from 2022–2032.”

Starlink’s key advantage is in its business model, not the orbit, suggests NSR. The report adds: “When analysing Starlink, it is easy to attribute Starlink’s success to its use of LEO. But when further examining Starlink’s core revenue streams, the attributes of LEO make up a small part of SpaceX’s success. For example, lower latency is always referenced as an advantage of LEO, but the vast majority of use cases work perfectly fine over GEO. In fact, lower latency is disappearing from the sales pitch of LEO players, and they have been unable to monetise or differentiate based on latency. Similarly, LEOs have very low satellite usability (20–30 per cent) as the physics of the orbits make the satellite spend most of its time over areas with no demand. This puts LEOs’ cost-effectiveness under question in comparison to GEO.”

However, the report continues: “No other player in the satellite value chain can match Starlink’s pace in terms of innovation. Every batch of Starlink satellites is different,” suggests NSR. The analysts add that Starlink’s ability to add to and innovate its on-board technology puts it well ahead of its geostationary competitors such as Viasat. With D2D to come and its 5G-like ability, another potential revenue stream is created. Starlink is very unique in many aspects, for example, being vertically integrated and having favourable access to funding, which puts its competitors in a difficult position to match its fast technology evolution. But one of the key elements for accelerating innovation in the traditional satellite value chain is the adoption of 5G concepts and standards.”

NSR concludes by saying that from a service perspective, 5G will also make service provisioning easier, faster and more flexible.

“It will also enhance many network features, specifically security, slicing and traffic optimisation. The concept of 5G ‘network of networks’ is fundamental to develop multi-orbit services and satellite-terrestrial integrated offerings. Ultimately, 5G will facilitate satellite adoption by mainstream telecoms operators unlocking new revenue streams,” notes NSR.