Report: Netflix pipeline leads to consecutive quarters of share growth

April 18, 2024

Two years after small subscriber losses disappeared an eventual $200 billion in shareholder value, Netflix has almost fully recovered its peak share price, and kicks off the latest round of media and entertainment earnings with the wind at its back reports Parrot Analytics

When analysing key metrics such as subscribers, profitability, and audience demand, it’s clear that Netflix is pulling away from the competition and everyone else is fighting for second place.

The streaming giant has now grown its global market share of streaming original demand for two quarters in a row, a first in the modern streaming era (Q4 2019-present). Netflix’s originals share steadily shrunk over the past four years as competition increased, from 55.7 per cent in Q1 2020 to 33.3 per cent in Q3 2023, before bouncing back up to 33.9 per cent as of Q1 2024.

While that gain may seem small, any sort of recovery in this category is a remarkable show of force that has been followed by massive subscriber gains. A big reason for Netflix’s increase in demand share is its ability to dominate supply, allowing the company to recover from last year’s strikes and pump out new content faster than the competition.

Netflix’s password sharing crackdown is working far better than many anticipated with little impact on churn. Should this reignited growth begin to slow later this year, however, Netflix can fall back on its renewed funnel of licensed titles from Warner Bros Discovery, Paramount Global, Disney, NBCUniversal and beyond.

Dominating in demand for originals while also re-establishing itself as the go-to home for recent theatrical films, comfort sitcoms and laundry folding procedurals has cemented Netflix as the largest TV network in the world (without any major mergers and acquisitions). As Netflix strengthens its hold on the global streaming market, it will still need new types of content to fill in the gaps of its most popular series, which are getting longer and longer.

This will come in the form of live events. The upcoming Mike Tyson vs Jake Paul in July fight will be a good case study in Netflix’s ability to build an audience for an original live event. The biggest question when it comes to live sports is whether Netflix will make a serious bid for part of the upcoming NBA rights package, most likely the NBA Cup, and how WWE performs on the service and with advertisers beginning in 2025.

Taking the streaming throne wasn’t easy despite Netflix’s first-mover advantage. It required tens of billions of dollars, hard fought strategic development and an unrivaled amount of patience. While keeping the throne looks to be a tad easier at this current juncture, it is by no means a reason to stop evolving. As much as media has changed in the last decade, it will likely change even more over the next 10 years and Netflix plans to be at the vanguard of it all.

Netflix Streaming Original Supply Share

- Netflix has been able to pull away from the field because it has a much deeper trench of ready to release content.

- Looking at the supply share of new premieres during each quarter, the impact of Netflix’s increased competition is even more stark. As recently as Q3 2021, Netflix accounted for 30.2 per cent of all new streaming original titles released globally that quarter. Fast forward to Q3 2023 and Netflix’s share of new streaming originals worldwide was down to 14.7 per cent.

- However, Netflix reversed this trend big time in Q4 2023 — accounting for 27.4 per cent of new streaming original premieres, nearly doubling its supply share compared to the previous quarter. While that share dropped to 23.1 per cent in Q1 2024, it’s still higher than at any point since Q1 2022.

- This was clearly the result of Netflix having a thorough roster of new content in the can — something co-CEO Ted Sarandos emphasised repeatedly in 2023 — and a more global footprint than most of its competitors.

- Q4 2023 was the first time since the ‘Streaming Wars’ began in earnest in which Netflix’s global demand share grew quarter over quarter, with an ever so slight increase from 33.3 per cent to 33.4 per cent. It built on this in Q1 2024, ticking up further to 33.9 per cent globally.

- This may seem small, but it is a telling datapoint. It means that for two quarters in a row the growth of global demand for programming from legacy-backed and niche streamers is no longer outpacing the growth in demand for Netflix series, bucking a roughly four year trend.

- Since Netflix’s global share of the supply of streaming originals is down to 25 per cent in Q1 2024, 33.9 per cent demand share should be considered an over-performance. Netflix is still delivering strong value to its subscribers especially with streaming originals — a key leading indicator of subscriber growth. It also means Netflix has room to raise prices without incurring significant subscriber losses.

- That said, four years ago, Netflix was outperforming its supply share by a much higher margin. In Q1 2020, Netflix had 32.4 per cent supply share of global streaming originals, and 55.7 per cent demand share.

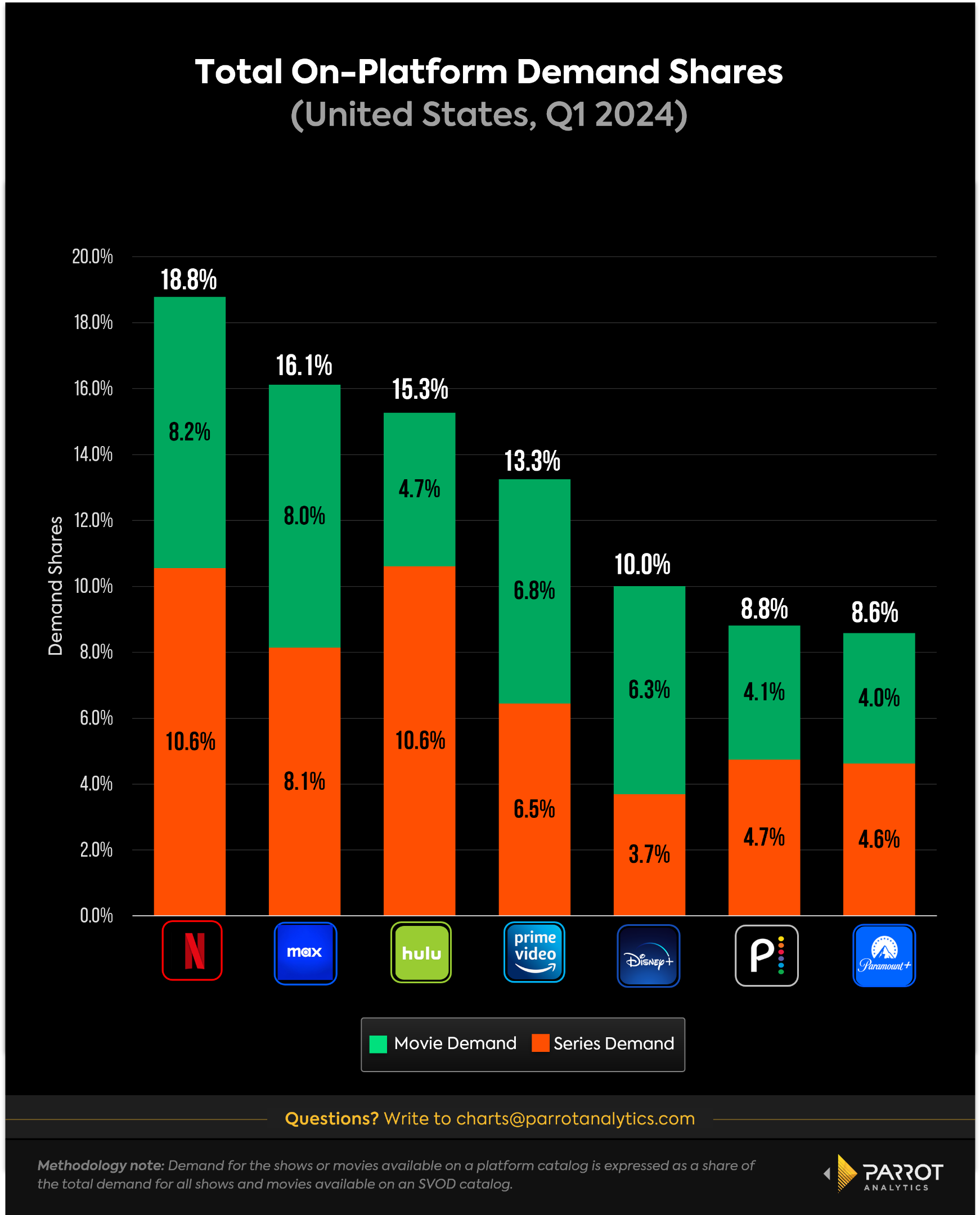

- While demand for original content drives subscription growth, library content is key for customer retention, and catalogue demand is a good indicator of which SVoDs consumers are most likely to use as a default ‘streaming home.’

- Netflix remained in first place here, increasing its position in Q1 2024 to 18.8 per cent, up from 18.1 per cent.

- The share of on-platform demand rarely shifts more than a fraction of a percentage point, so growing 0.7 per cent in one quarter is significant, and points to the increasing strength of Netflix’s library.