Liberty Global “in great shape” despite subs decline

May 2, 2024

Liberty Global has reported tht Q1 revenue increased 4.1 per cent YoY on a reported basis and 1.9 per cent on a rebased basis to $1.94 billion (€1.81bn). Q1 net earnings (loss) increased 173.9 per cent YoY on a reported basis to $527 million.

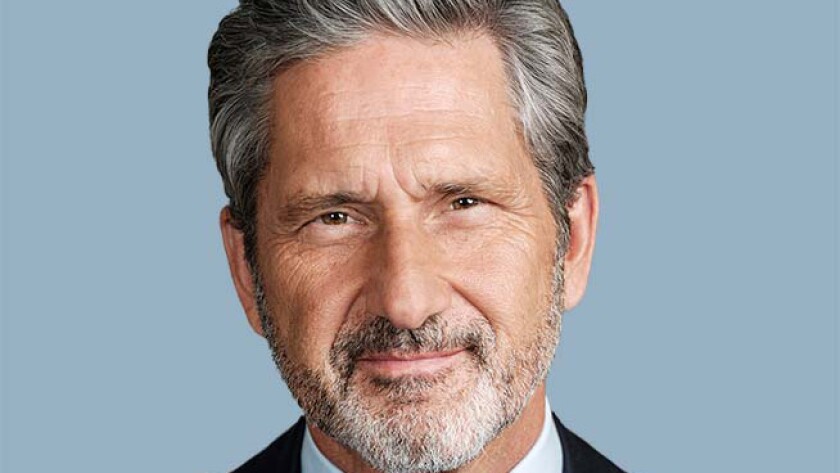

CEO Mike Fries stated: “On our extended fourth quarter results call we presented a clear pivot in our strategy which will see us not only focus on maximising the long-term value of our core FMC assets, but also delivering that value directly to shareholders over time. During Q1 we made significant progress on the initiatives we announced, including our plan to spin-off Sunrise, which is on track for Q4 this year.”

“Our balance sheet remains in great shape, with $3.9 billion of cash and liquid securities, supported by strong Adjusted FCF generation and the ability to replenish liquidity through asset sales. We recently completed a proactive $2.4 billion VMO2 refinancing where we successfully extended the average life of our total UK debt stack with a negligible impact to VMO2’s WACD. We remain committed to shareholder remuneration, having already repurchased ~3 per cent of our shares through April 26th against our target of up to 10 per cent of shares by year-end. Meanwhile our Ventures portfolio, valued at $3.4 billion, represents an attractive platform to support our FMC operations, drive returns, and create significant value over time.”

“We continue to invest in our fibre-rich, fixed and 5G mobile networks and, while this is driving elevated capital intensity today, it remains critical to underpinning the long-term asset values of our OpCos. Our fibre upgrade projects in the UK, Belgium and Ireland remain on track, and nexfibre recently announced it had reached the milestone of one million premises built in the UK, as VMO2 fibre build capacity continues to ramp up. Meanwhile, we’re continuing to invest in digital and AI initiatives to support commercial momentum and efficiencies.”

“Our overall financial performance in Q1 was in line with expectations, highlighted by the return to strong Adjusted EBITDA growth in the Netherlands and the return to positive broadband net adds in Switzerland. Fixed ARPU trends in the UK and Switzerland improved while our businesses in Belgium and the Netherlands each delivered continued fixed ARPU growth. We are on track to meet our full-year 2024 guidance metrics across all OpCos, with price adjustments recently announced in the UK, the Netherlands and Belgium to support our financial targets,” Fries concluded.

Sunrise

During Q1, Sunrise delivered 6,200 broadband net adds, primarily driven by an improved main brand performance from customer loyalty initiatives, as well as continued trading momentum in flanker brands. In mobile, Sunrise continued to drive commercial momentum, delivering 26,000 postpaid net adds. FMC penetration remains high at 59 per cent across the Sunrise broadband base.

The Swiss telco saw revenue of $854 million in Q1 2024, up 5.8 per cent YoY on a reported basis and was flat on a rebased basis.

Telenet

Telenet’s postpaid mobile base declined by 800 while its broadband base declined by 6,000. The net subscriber trend in the first quarter continued to be impacted by higher annualised churn from the intensely competitive market environment, which more than offset the improved sales performance from Telenet’s latest marketing campaigns.

Wyre, Telenet’s NetCo partnership with Fluvius, in which it holds a majority 66.8 per cent stake, is well on track to achieve its FTTH rollout plan, whilst continuing to explore ways in which it can maximise efficiency of such rollout. FMC penetration remains high at 49 per cent of the broadband base. In April, Telenet extended its digital ecosystem through Blossom, an all-in-one digital solution for the installation of charging stations and smart

charging for electric cars.

The Belgian broadband provider posted revenues of $762.6 million in Q1, down 1.1 per cent YoY on a reported basis and decreased 0.5 per cent on a rebased basis.

Virgin Media O2

VMO2’s fixed customer base declined by 2,000 in Q1, primarily driven by a reduction in gross adds. The broadband base grew by 5,300 in Q1, while growth in broadband speeds continued, as average download speed increased 17 per cent YoY to 368Mbps.

The company saw revenues of $3,282.8 million in Q1. See full result details here.

VodafoneZiggo

During Q1, FMC net adds increased by 22,700 to almost 2.7 million, delivering significant Net Promoter Scores along with customer loyalty benefits. FMC penetration remained stable at 48 per cent. Mobile postpaid net adds grew 22,300 alongside growth in mobile postpaid ARPU of 3.4 per cent YoY, supported by the price indexation implemented in October. The broadband base contracted by 23,500 in the quarter, a 3,000 improvement compared to Q4, as a 26,600 decline in Consumer was only partially offset by a 3,100 increase in B2B.

Revenue increased 2.8 per cent YoY at the Dutch JV on a reported basis and 1.6 per cent YoY on a rebased basis to $1.11 billion in Q1.