Survey: Most young viewers would pay to stream new movies

July 8, 2020

Hub’s annual Monetizing Video study looks at the pay models that US consumers prefer – and the entertainment services they feel offer the greatest value.

Among other things, this year’s study shows that at a time when movie theatres are closed, or have restricted occupancy, young consumers see streaming as a way to satisfy their first-run movie fix.

Highlights from the study:

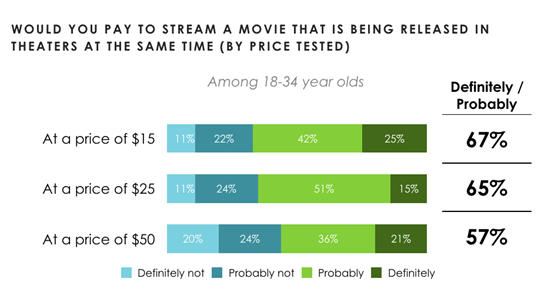

- Young consumers embrace the notion of streaming a movie at the same time it’s released in cinemas.

- More than 6 in 10 18-34 year olds say they’d definitely or probably pay to stream a just-released movie.

- By contrast, interest in the idea is nearly non-existent among consumers 35+: just 12 per cent, with only 2 per cent saying “definitely”.

- These young consumers are relatively price insensitive when it comes to streaming a first-run film.

- Assuming a price of $15 to stream, 67 per cent of 18-34 year olds would definitely or probably pay. The proportion is virtually the same (65 per cent) at $25.

- However, a majority of young viewers (57 per cent) would also be willing to pay $50.

- Across the full range of TV services consumers use, the top four in terms of perceived value for the money are all streaming services.

- 7 in 10 say that Netflix, Hulu, Disney+, and Amazon Prime video offer excellent or good value for the money.

- Among traditional pay TV subscribers (cable, satellite, telco), only about 4 in 10 feel they get at least good value.

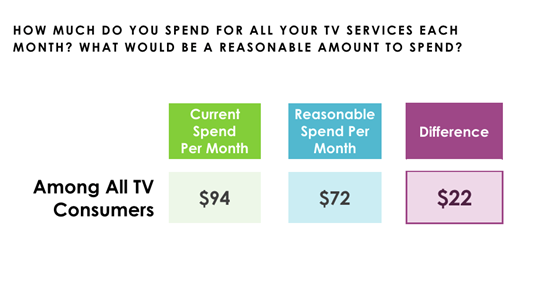

- On average, consumers feel they’re paying $22 more each month for TV services than they should be paying.

- We asked consumers to estimate how much they pay for all their TV subscriptions combined: the mean amount was $94 per month.

- We then asked what they would consider to be a reasonable cost for the services they get today: that mean was $72 per month.

- Traditional pay TV subscribers are the most likely to feel their total TV bill is higher than what’s reasonable.

- Those who have a cable, satellite, or telco subscription—whether or not they also have streaming services—feel they pay $29 more than they should be paying.

- For consumers who only have cable, satellite, or telco service, the actual vs. reasonable gap is actually greater: they pay $37 more than they consider reasonable.

- With an actual/reasonable gap of only $6, consumers who have streaming services only—no pay TV service—are the most likely to feel they’re paying the amount they should be paying.

“At a time of tremendous economic uncertainty, streaming services with deep catalogues of content fill a critical emotional need for consumers: the need to satisfy their at-home entertainment needs at a manageable cost,” said Peter Fondulas, principal at Hub and co-author of the study.

“What’s more, for younger movie fans, access to first-run films via streaming would allow them to satisfy their movie fix for less than the price of a trip to the theater. The strong preference for streaming, for TV and first-run movies, has the potential to fundamentally shift the entertainment distribution dynamic, assuming the industry is ready to accept the collateral damage—to the pay television and theater industries—such a move would leave in its wake,” he addded

Hub’s study was conducted among 2,036 US consumers with broadband, age 16-74, who watch at least 1 hour of TV per week. The data were collected in June 2020.