Research: Consumers using savings to cover media subs

July 18, 2022

Almost a third (29 per cent) of individuals have struggled to pay for their media subscription services since the start of 2022, with people needing to borrow money or use savings to pay their bills according to KPMG research. The survey of UK consumers conducted by OnePoll found that 15 per cent have missed or defaulted on a payment for a media subscription service in the last three months.

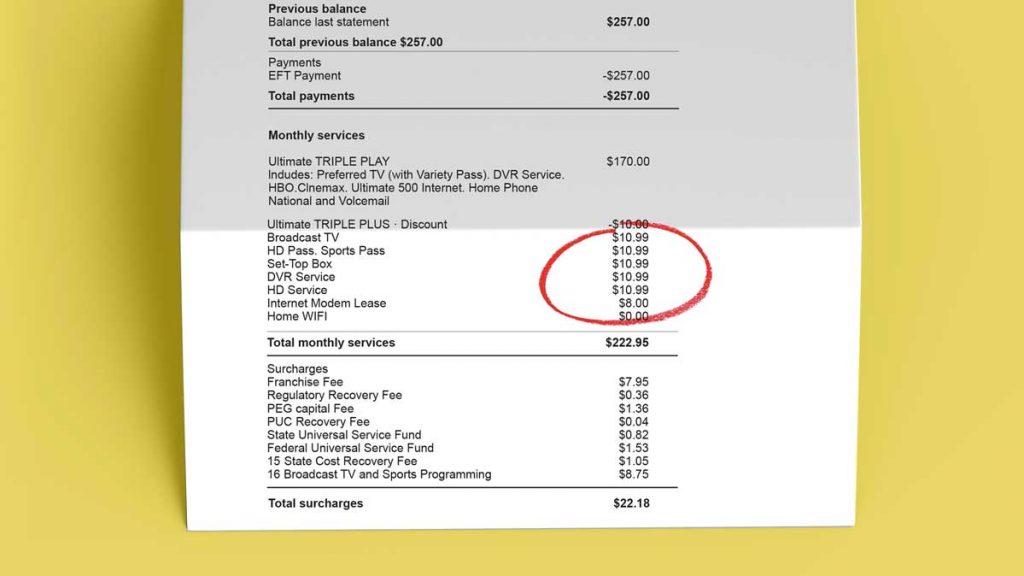

Many media companies have also been affected by rising costs, which they have had to pass on to their customers. The data revealed that consumers have seen their bills for all media subscription services rise this year:

When asked why they are cancelling media subscriptions, nearly half (48 per cent) said it was because the company put their prices up and it became too expensive.

The cost-of-living crisis is also having an impact: two-thirds of consumers (64 per cent) said they are decreasing the number of media subscriptions they pay for because are worried about the general increase in the cost of living and want to save money. This was the primary reason given by all age groups.

Many people have stopped subscribing to some services to pay for higher food bills this year, which are expected to rise at a rate of 15 per cent this summer, according to the Institute of Grocery Distribution: 19 per cent have sacrificed a video streaming service; 15 per cent have ditched a TV provider; 14 per cent have stopped paying for a music streaming platform and 15 per cent have terminated a mobile contract due to increasing food prices.

“While consumers and media companies alike are feeling the pinch, organisations’ customers will value them in the long term if alternative payment options or plans can be introduced to help them continue to use their services – especially for essentials such as mobile,” advises Ian West, Head of TMT KPMG UK. “Unfortunately, the current crisis is unlikely to disappear anytime soon, and I hope that this industry adapts to support their customers in times of difficulty.”

Focusing on younger age groups, they were found to have the highest number of subscriptions and pay the most in total for their combined media subscription services:

- At the beginning of the year, 18–24-year-olds had on average 21 different media subscriptions whereas the over 65s had just 13.

- 19 per cent of 18–24-year-olds are spending £151-£200 per month compared to just 3 per cent of 55–64-year-olds and 5 per cent of those over the age of 65.

- Therefore, this younger group is more exposed to fluctuations in prices which could explain why three quarters (74 per cent) of 18–24-year-olds are planning to end a subscription in the next six months, while only 21 per cent of those aged 55-64 and 32 per cent of 65 and over think they will do so.

- Price hikes are hitting the youngest most: looking at mobile phone bills, 90 per cent of those aged between 18-24 have seen their monthly bill go up this year, compared to just 39 per cent of those in the 55-64 age bracket.

- With video streaming services, 90 per cent of the 18-24 age group have seen an increase in their monthly payments, compared with 41 per cent of 55–64-year-olds.

“It is evident that younger age groups will cut back most on their media subscriptions,” states Linda Ellett, UK Head of Consumer Markets, Leisure & Retail, KPMG UK. “This can be partly attributed to the fact that they are likely to have a comparatively lower disposable income than other demographics, and typically exhibit less loyalty and more switching in other purchasing behaviours. It’s also evident that younger age groups have more subscriptions and were spending higher amounts in the first place, meaning they have greater flexibility in being able to make changes to save money.”

Other key findings include:

- Video streaming companies are most vulnerable to a drop in subscriber numbers, with over a fifth (22 per cent) of consumers saying they will reduce the number of these services they pay for in the next six months.

- This figure was 18 per cent for TV providers, 16 per cent for music streaming and 14 per cent for mobile.

- Analysing how much people are cutting back overall, 8 per cent have reduced their monthly spend on media subscription services by £1-5; 18 per cent have cut it by £6-10; 12 per cent have cut back by £11-15 and 5 per cent said they have reduced their bills by £16-20 per month.

“The dip in subscriber numbers seen so far is merely the tip of the iceberg,” advises West. “The data reveals that since the start of the year consumers are paying for roughly the same number of media subscription services, with the average number declining from 14.2 to 14 overall. Clearly, people haven’t scrapped too many services yet, but are likely to do so in earnest in the second half of 2022.”