Nielsen: US takes viewing momentum into December

January 20, 2023

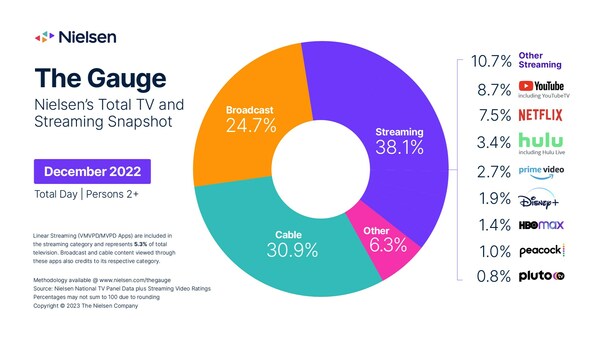

Nielsen’s December 2022 TV usage summary from The Gauge, the media measurement company’s monthly snapshot of total TV and streaming consumption in the US, revealed that TV viewing remained high in December, continuing momentum from November when time spent watching television soared 7.8 per cent from the month prior.

Similar to November 2022, December also recorded five days with over 100 billion minutes of TV viewing, including two of the top 10 most-watched days of television in 2022 (December 18th and December 25th).

While December’s TV usage was fairly flat on a monthly basis, the slight 0.3 per cent increase gave it an edge over November to solidify it as the second-highest month in overall TV consumption in 2022, behind January. Despite a robust month of TV usage, the Broadcast, Cable and Streaming categories all lost in share, leaving the ‘Other’ category as the only to gain in December (+2 share pts). Growth of the ‘Other’ was driven in part by increased video game play.

Similar to overall TV usage, December streaming usage was nearly even with November (+0.2 per cent) and represented 38.1 per cent of TV, losing one-tenth of a share point due to rounding. Compared with December 2021, time spent watching streaming content was up 46.1 per cent on a yearly basis and has gained 10.4 share points, climbing from 27.7 per cent to 38.1 per cent of total TV usage.

Peacock made its debut in The Gauge this month, initiating coverage with a 1 per cent share of TV and consistent growth demonstrated across previous measurement intervals. Peacock’s success in December coincides with the success of the Peacock Original The Best Man: The Final Chapters (pictured), which was released just before Christmas. Monthly changes across other named streaming platforms include:

- Viewing on HBO Max climbed by 18.1 pr cent — the largest usage increase across all named streaming platforms in The Gauge this month – and represented 1.4 per cent of total TV consumption (+0.2 share pts.).

- Netflix and YouTube each lost one-tenth of a share point vs November, finishing at 7.5 per cent and 8.7 per cent of television, respectively.

- Hulu usage was down 11 per cent in December, which translated to 3.4 per cent of TV (-0.4 share pts.).

Viewing of linear television on MVPD (multichannel video programming distributor) and vMVPD (virtual multichannel video programming distributor) apps represented 5.3 per cent of total television usage and 14 per cent of streaming usage in December (compared with 5.8 per cent and 15.2 per cent, respectively, in November). YouTube TV accounted for 14.3 per cent of YouTube viewing (1.2 share points), and Hulu Live made up 10.1 per cent of Hulu viewing (0.3 share points). Broadcast and cable content viewed through linear streaming apps also credits the respective category.

Broadcast usage was down 3.7 per cent from November, and the category lost a share point to finish at 24.7 per cent of total television. The decline to broadcast viewing was driven by a sharp decrease in viewing to the general drama genre (-20 per cent), and broadcast sports (-12.3 per cent). Broadcast viewing in December was fairly flat compared with one year ago (+0.3 per cent), and the category lost 1.4 share points.

Cable viewing declined 2.4 per cent versus November to end the month with a 30.9 per cent share of TV. The changes in cable were driven by a 10.2 per cent drop to cable news viewing, and the feature film genre, which jumped nearly 5 per cent to 22.1 per cent of cable viewing. On a year-over-year basis, time spent watching cable content declined 12 per cent and the category lost 6.4 share points.