Forecast: Ad spend to slow in 2023

August 24, 2022

Ad spend around the globe will rise 8.3 per cent in 2022, before slowing significantly in 2023. In its latest report, WARC, a provider of marketing insights, downgrades its expectations for global ad market growth by $90 billion (€90.4bn) in the face of a wider economic slowdown.

These are the figures presented in WARC’s Ad spend Outlook 2022/23: Impacts of The Economic Slowdown:

- Global ad spend is set to reach $880.9bn this year – a rise of 8.3 per cent or $67.3bn

This is largely down to cyclical boosts from major events like the US midterm elections and the men’s FIFA World Cup, both taking place in November, which will animate H2 growth. Big brands appear to plan to sustain their spend. - Growth to slow significantly to just 2.6 per cent in 2023

The new projections, based on data from 100 ad markets worldwide, amount to a downgrade of 4.3 percentage points (pp) to 2022 growth and 5.7pp to 2023’s prospects, compared to WARC’s previous global forecast in December 2021 – a reduction of close to $90 billion in potential growth over the two years. - Social media’s $40bn shortfall amid slowing growth

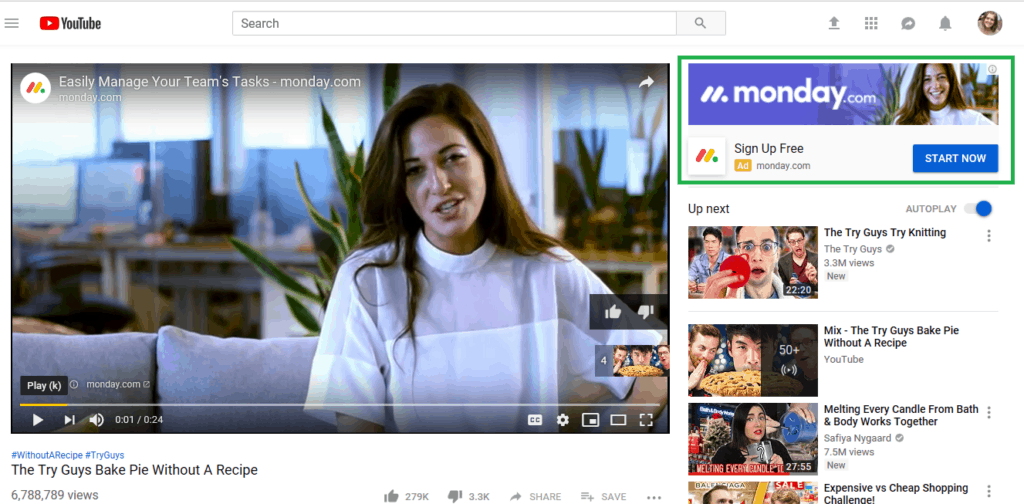

WARC expects the impact of Apple’s privacy measures on social media companies that rely on cross-site tracking will be in the region of a $40 billion hit to their bottom lines over the course of this and the coming year. Most are expected to see far less growth than they are used to over the forecast period. Overall, social is expected to rise 11.5 per cent (compared to +47.1 per cent in 2021) in 2022 before cooling to just 5.2 per cent – its slowest ever period of growth.YouTube’s fortunes have also proven vulnerable to privacy changes on Apple devices; WARC believes that YouTube’s advertising revenue will rise 7.3 per cent this year (compared to +45.9 per cent in 2021), but that its growth will then ease to 5.6 per cent in 2023.

- Investment keeps coming

Just four of the 18 product sectors that WARC monitors are expected to cut ad spend in 2023, but the profile and rate of the cuts is interesting: transport & tourism (-0.4 per cent), alcoholic drinks (-1.1 per cent), financial services (-4.5 per cent) and automotive (-12.4 per cent). So where is the above shortfall coming from? Small and medium sized businesses are big spenders on social advertising, and as they are hit hard they will struggle to spend. - AVoD market heats up as streaming becomes war of attrition

Advertising spend in the video streaming sector is set to grow faster than the total ad market this year (+8.4 per cent) and next year (+7 per cent). The AVoD sector – including Hulu, Prime Video and YouTube – is expected to rise 8 per cent this year and then a further 7.6 per cent in 2023 to reach a value of almost $65 billion.Broadcaster-owned streamers are also set to grow their advertising income this year (+9.7 per cent) and next (+5.2 per cent), but from a far lower base (reaching $18.5 billion in 2023). Linear TV, meanwhile, will grow by 3.6 per cent to $180 billion (20.4 per cent of all advertising spend) but the market is then on course to record a 4.5 per cent loss in the absence of these events next year.

“With the growth rate of global output now set to halve and acute supply-side pressures fanning inflation, the economic slowdown has removed close to $90 billion from global ad market growth prospects this year and next”, said James McDonald, Director of Data, Intelligence & Forecasting, WARC. “Yet brands are still spending as the Covid recovery continues, and global ad trade remains on course to top $1 trillion in value by 2025. Platforms with rich sources of first-party data – most notably Amazon, Google and Apple – are well placed to weather future headwinds by offering measured performance in a climate where return on investment becomes paramount.”