Research: Modern viewers app-agnostic

November 29, 2023

In the latest edition of its ‘Behind the Screens’ insights series, Samsung Ads reveals how the increased ease of discoverability and app ‘surfing’ are driving new Smart TV behaviours, signalling the end of a decade long ad-free TV streaming experience.

During the first half of this year, there were more than 7.1 billion app opens on Samsung Smart TVs in the EU5, 1.7 billion of which were in the UK. This represents a +3 per cent MoM growth in the UK, signalling a growing shift towards app-based TV viewing.

The rise in streaming, both exclusively and through a combination with linear viewing, is showing no sign of slowing down with 84 per cent of Samsung TV owners now streaming (+11 per cent YoY). In September 2023 alone, exclusive streamers averaged 81 hours per TV per month.

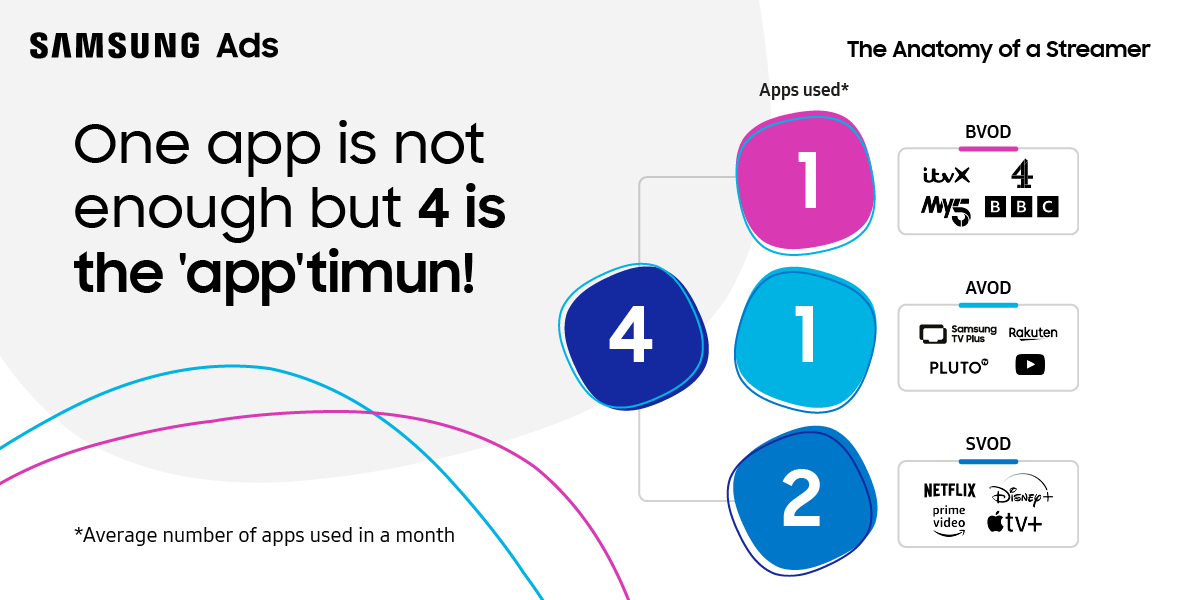

On Samsung devices, viewers were creatures of habit when it comes to app usage. Looking strictly at app-based TV, 14 per cent of devices use the same app, every day or every time they turn on the TV. The average device regularly uses two SVoD services, one advertising video-on-demand (AVoD) service and one broadcast video-on-demand BVoD service.

With the rapid advancement in streaming-based apps, streamers have diversified where they find their content as they battle with discovery paralysis and content overload. TV owners are in discovery mode with 39 per cent of multi-touchpoint sessions flicking between on average three different apps in a single sitting. However, instinct seems to win out: more than half (57 per cent) also show this shifting behaviour but end up back on the first app.

FAST grows while SVoD plateaus

When looking at total time spent viewing, ad-funded streaming saw 18 per cent year-on-year growth, with FAST in particular growing by 32 per cent. BVoD takes up less time overall on devices but has seen strong growth of 24 per cent.

SVoD is still by far the highest app category by adoption, with 87 per cent of streamers accessing this content type. SVoD also dominates overall time spent but has seen the slowest growth compared to other VoD types, at 7 per cent, suggesting less headroom.

There were also clear age differentiators; Gen Z watched an average of 2 hours and 5 minutes of streamed content per day, compared to just over an hour for Boomers.

AVoD is for anytime

Peak prime-time TV was dominated by linear, BVoD and SVoD, highlighting their prominence within the nation’s households. However, our behaviour with AVoD was strikingly different. Daily peak hours for BVoD, SVoD and linear all sat around 8pm – 10pm, whereas AVoD peaked during 6-8pm and was consistently used throughout the day, during which time the trio were less prominent. Gaming also dominated late-night over the weekend – mirroring SVoD trendlines.

This juxtaposition was also seen when comparing weekly usage. SVoD and Gaming peaked over the weekend, highlighting the UK’s ‘binge watching’ and gaming-marathon tendencies – during which period BVoD and AVoD slumped.

Ad-free or ads with fee

One of the biggest changes in the last 12 months has been the introduction of ads to subscription platforms, as services rethink strategies to appeal to a wider set of more cost-conscious viewers. Netflix has revealed that its ad-supported tier now accounts for 15 million subscribers, 30 per cent of its overall subscriptions, while other paid streaming services revealed that ad-supported plans are already proving more lucrative per user than a pure subscription play.

This works for customers, with GWI finding that 54 per cent of customers cancel subscriptions due to cost, and 39 per cent because of paying for too many services. The appeal of ads continues to grow, with over half of UK consumers saying they don’t mind watching ads in return for free content (76 per cent) – and that appetite would be even higher if fees were reduced further.

Increasing production costs, writers strikes and consumer belt-tightening have also taken their toll on the streaming industry, with several big players reportedly looking to cut billions in costs.

“TV is still TV and viewers love to enjoy great content, but how they get to that content has changed drastically,” notes Matt Bryan, Director of Analytics & Insights, Samsung Ads Europe. “With SVoD reaching maturity, app-based viewing now dictates how we make decisions on what content to watch and AVoD and FAST are seeing a significant shift here too. The challenge for apps now is to attract new viewers and prevent churn. Leveraging key insights such as these will be what sets apps apart and bolster their capabilities in such a crowded and competitive market.”

“In this (re)emerging ad-funded era, it’s clear that cost and content prevail,” adds Alex Hole, Vice President and General Manager, Samsung Electronics Europe. “After a decade of ad-free streaming, it’s encouraging to see platforms shifting their focus on drawing in the widest audience by catering to all wallet sizes and addressing all wants and needs. With the rise of TV app based viewing, behaviour is becoming even more complex within TV – making it important to factor in these growing streaming audiences.”