Research: Streaming stretches TV generation gap

August 17, 2022

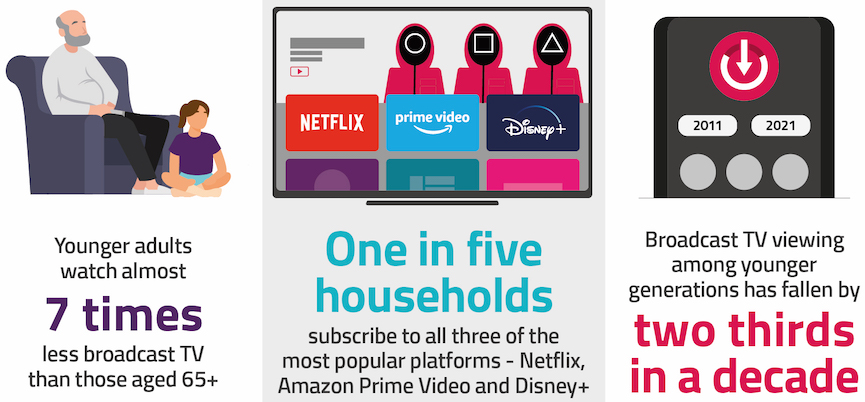

Younger adults now watch almost seven times less scheduled TV than those aged 65 and over, according to the findings of the Media Nations 2022 report from UK media regulator Ofcom, as the generation gap in media habits reaches a record high.

People aged 16-24 spend less than an hour (53 minutes) in front of broadcast TV in an average day – a fall of two-thirds in the last ten years.

In contrast, those aged 65 and over still spend around a third of their waking day enjoying broadcast TV, sitting down for almost six hours (5 hours and 50 minutes) daily. This is actually slightly higher than a decade ago.

The changes in younger adults’ habits reflect the soaring popularity of US-based, on-demand streaming services

Three streaming giants in a fifth of homes

Around a fifth of homes (5.2 million) subscribe to all three of the most popular platforms – Netflix, Amazon Prime Video and Disney+ – costing around £300 (€357) per year.

Nine in ten 18-24-year-old adults bypass TV channels and head straight to streaming, on-demand and social video services when looking for something to watch, with Netflix the most common destination.

However, six in ten (59 per cent) 55-64-year-olds and 76 per cent of those aged 65+ still turn to TV channels first.

“The streaming revolution is stretching the TV generation gap, creating a stark divide in the viewing habits of younger and older people,” notes Ian Macrae, Ofcom’s Director of Market Intelligence. “Traditional broadcasters face tough competition from online streaming platforms, which they’re partly meeting through the popularity of their own on-demand player apps, while broadcast television is still the place to go for big events that bring the nation together such as the Euro final or the jubilee celebrations.”

Cost of living concerns

After years of strong growth, the number of homes using streaming services began to slow in 2021, before starting to decline in spring of 2022.

As the rising cost of living puts pressure on household budgets, the number subscribing to at least one streaming service fell by more than 350,000, to 19.2 million.

However, cancellations do not necessarily represent customers that have been lost for good. Ofcom’s survey of subscribers who cancelled earlier in 2022 found that almost three quarters (73 per cent) of customers said they thought they would resubscribe – reflecting the flexibility that allows customers to pick up and drop subscriptions depending on changes in programmes, needs or circumstances.

Challenge for public service broadcasters

Viewing figures of more than 10 million for the Women’s Euro 2022 final and the Queen’s Platinum Jubilee show that broadcast television is still a popular choice for momentous national events, but public service broadcasters continue to see both audiences and levels of viewing fall.

However, there is better news for their on-demand ‘player’ apps.

Overall, 82 per cent of people said they used a PSB on-demand service in the past six months, roughly the same proportion who said they used at least one streaming service (83 per cent). Six in ten (59 per cent) viewers said they used these platforms to watch channels or programmes live at the time they are broadcast.

As a result, the average time spent watching services such as BBC iPlayer, ITV Hub and All 4 increased to 15 minutes per day, up by three minutes per person per day, bucking the trend of post-pandemic declines in viewing time.

And BBC iPlayer has a high level of satisfaction across all age groups, with over four in five (81 per cent) of those who had used it recently saying they were satisfied with the service.