Data: Advertisers increasing Instagram ad spend

September 1, 2022

Analysis from advertising intelligence and sales enablement platform MediaRadar suggests that some advertisers are continuing to increase their spend on Instagram despite the recession.

Among all categories, Media & Entertainment remains a hot category for the platform. MediaRadar tracked infeed image, carousel and video ads captured from a panel of over 2 million US users.

Instagram advertisers’ ad spend breakdown:

- 87 per cent (15,200) of Instagram advertisers sampled spent less than $50,000 (€49, 935) so far in 2022 (through Q2). However, the combined spend of these companies was over $114 million.

- Instagram attracts small advertisers. Over 8,700 (50 per cent) of those companies spent less than $10,000.

- $147 million was spent on Instagram ads from the 511 companies that invested between $50,000 – $149,000 (through June).

- Expanding to companies with Instagram ad spend over $500,000 (nearly 1,100) – the combined spend tops $4.3 billion so far in 2022.

- According to MediaRadar’s data sample, over 17,500 companies invested in Instagram ads, spending nearly $4.7 billion through Q2. Top five advertising categories on Instagram included media & entertainment, retail, apparel, tech and services – combined ad spend of $3.3 billion or 71 per cent of the total spend on Instagram. Diving into the top three categories:

-

- Media & Entertainment

- This category alone is 24 per cent ($1.1 billion) of total H1 2022 ad spend on Instagram. Despite concerns about the current climate – Q2 2022 saw an increase of 9 per cent QoQ in media & entertainment.

- Entertainment websites were a whopping 19 per cent (over $226 million) of the total media & entertainment ad spend. 22 Words, Dr. Nostalgia, and Hype Galore are some big Instagram ad investors – combined spend of nearly $60 million.

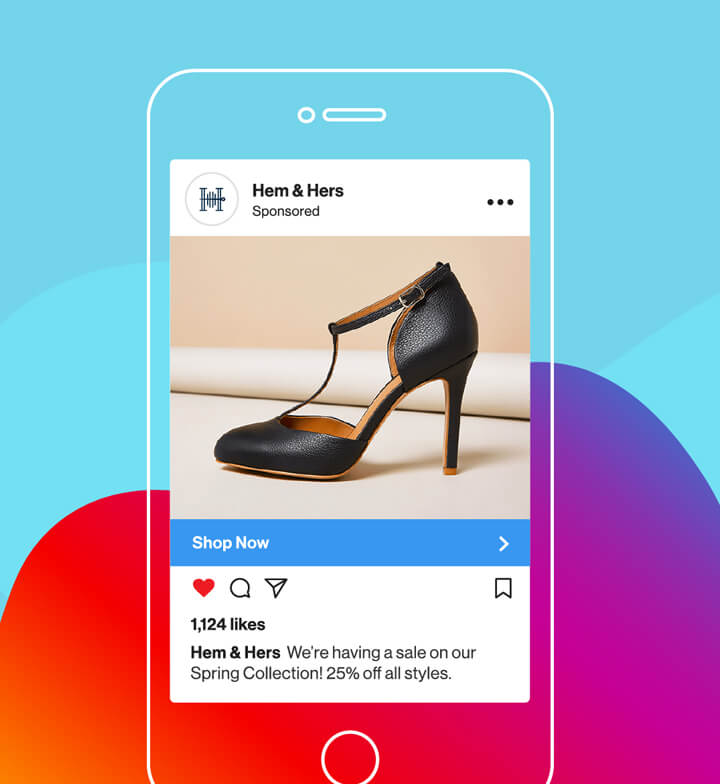

- Apparel

- 10 per cent of total H1 2022 ad spend on Instagram. Another category that is increasing despite concerns about a recession – Q2 2022 was up 9 per cent QoQ.

- Top sub-categories included: accessories, apparel, and athletic wear – which were 68 per cent ($331 million) of the total apparel ad spend during the first six months of 2022. Nike, Pandora, and Tapestry are apparel names advertising heavily on Instagram in 2022 so far. They had a combined spend of over $88 million.

- Retail

- Media & Entertainment

- The data sample showed retail is scaling back advertising spend. 21 per cent of total H1 2022 ad spend on Instagram. Q2 2022 was down 27 per cent QoQ. The biggest decreases – online department stores were down 48 per cent QoQ, general retailers decreased ad spend 40 per cent QoQ, and online marketplaces reduced investment 34 per cent QoQ.

- Some top subcategories during the first half of 2022 include: apparel retailers, home furnishing retailers, and online department stores – which were 49 per cent ($478 million) of the total retail ad spend through June. Home furnishing names such as Amazon, Bed Bath & Beyond, and IKEA invested more than $1 million in ads on Instagram. Gap, Guru, and Hot Topic apparel retailers spent $5 million+. Amazon and Overstock were top spenders – the sample data also showed Qurate Retail Group spending among those online department stores big names – combined ad spend for all three was over $132 million.