Analysis: Economy fears impact US Home Ent spend

September 15, 2022

Noting high inflation figures in the US, actionable intelligence firm Aluma suggests that households are realising that the economy is only at the beginning of what will be a long recovery. “It is in this context that home decision-makers search for ways to reduce expenses, among them communication and home media services,” it says.

When asked how they feel about the state of the current economy, one in six heads of household responded negatively (‘fair’ or ‘poor’). Only one in six viewed the US economy positively (‘good’ or ‘excellent’). This according to Aluma’s July survey of nearly 2,000 US heads of household.

Generally, householders 45 years of age and older feel worse about the state of the US economy than do those less than 45. Negativity was strongest among the 45-54 cohort, while positivity was strongest among the 35-44 cohort (22 per cent).

When asked how they feel about the future of the US economy, almost two-thirds of householders were either somewhat or very pessimistic. Decision makers between 45 and 54 years of age were most pessimistic about the future of the US economy (69 per cent negative), while those between the ages of 35 and 44 were the most optimistic about the economy’s future (40 per cent).

“US householders are roughly five times more likely to view the current economy negatively than positively, and two times more likely to believe the economy will further deteriorate versus improve,” notes Michael Greeson, founder and principal analyst at Aluma Insights. “The ‘good news’ is that positivity about the economy’s future is more than twice as high as positivity about the current economy, a small bit of light in otherwise dense economic fog.”

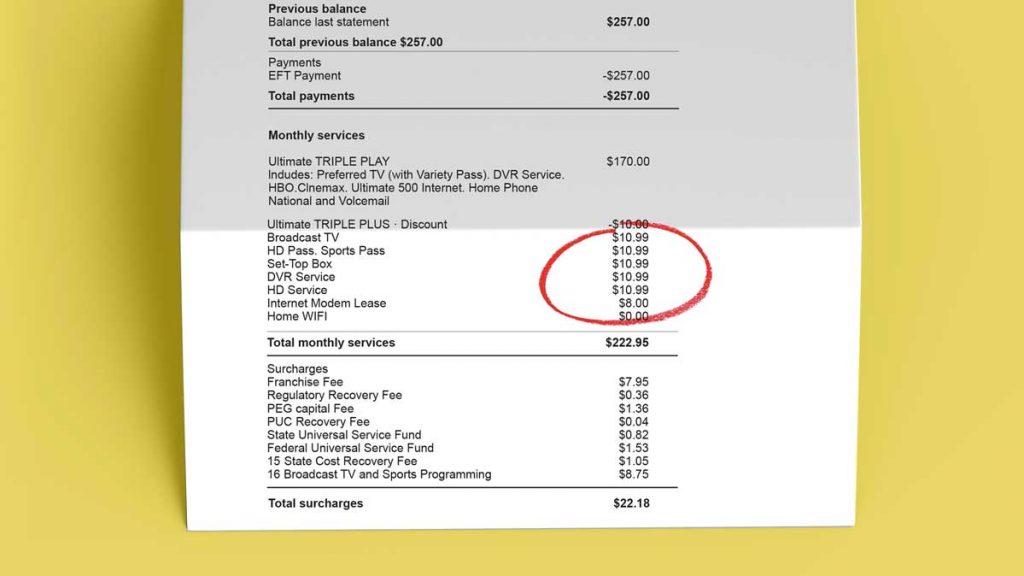

The impact of current and future views of the economy on the perceptions household decision-makers have about communications and home entertainment (CE) expenses is telling. Almost half of US households are disposed to reduce these expenses, with only 3 per cent open to spending more. (Note that communications expenses include Internet, landline phone, and mobile phone. Home entertainment expenses include pay-TV, SVoD, TVoD, game, and music services).

“The correlations between the likelihood of expense reductions and one’s perception of the economy are strong,” said Greeson. “Aluma research found nearly 90 per cent of those likely to cut back on their CE expenses view the current economy negatively, compared with only 11 per cent that view the economy positively. Same for 68 per cent of those pessimistic about the economy’s future and 55 per cent of those that view their financial situation as fair or poor. “How decision-makers view the current economy weighs more heavily than other economic factors on whether to reduce a CE expense or not.”