Research: Top 6 US AVoDs collect $1bn+ in advertising

December 14, 2023

MediaRadar, advertising intelligence and sales enablement platform, analysed US ad spend from the top six OTT ad-supported streaming services: Discovery+, Hulu, Max, Paramount+, Peacock and Pluto TV. Data was from January 1st 2022 through October 31st 2023.

Key findings include:

Top Six Streaming Platforms Collect Over $1 Billion in Advertising

From January through October 2023, MediaRadar’s data sample showed nearly $1.07 billion (€0.99bn) in advertising investment on the six top OTT platforms. This represents an 8 per cent year-over-year (YoY) decrease from the $1.2 billion spent last year.

“Streaming platforms are confronting steep hurdles around ballooning content expenses, password sharing dilution, and an uncertain economic climate. These factors are fueling downstream subscriber and advertising adversities across the industry.” stated Todd Krizelman, CEO of advertising Intelligence platform, MediaRadar. As evidence of the challenges, we observed an 8 per cent year-over-year decline in ad spend across six major streaming platforms from January – October 2023. However, the streaming ad market also shows promise – these players alone account for over $1 billion in spend over this period.”

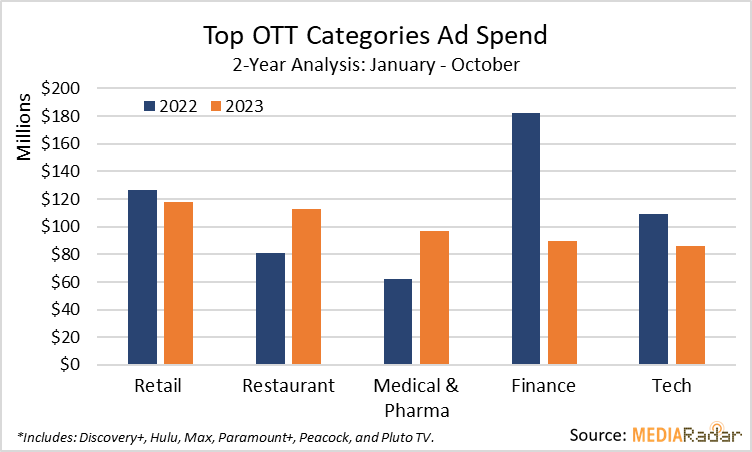

Top Five Categories Represent Nearly Half of Total Spend

The leading five advertising categories – restaurant, medical & pharma, finance, retail, and technology – constituted nearly $503 million, or 47 per cent of the total ad spend through October. Collectively, these categories saw a 10 per cent decrease in YoY spending.

The finance category, encompassing financial institutions, real estate, and insurance providers, experienced the most significant YoY decrease. Insurance companies, which contributed 68 per cent of this category’s spend through Q3 2022, dropped to 36 per cent in 2023. Major insurers like GEICO, State Farm, and Progressive slashed their spend from $123 million to $32.5 million through October 2023, marking a 74 per cent YoY reduction in OTT ad spend.

Restaurants and Pharma Increase Ad Spend

Among the top categories, restaurants and pharma were the only sectors to register increases in YoY ad spend. Restaurants experienced a 39 per cent increase, while medical & pharma observed a 56 per cent rise.

Quick service restaurants, representing 74 per cent of the restaurant category’s spend, surged by 38 per cent, with brands like McDonald’s, Taco Bell, and Subway amplifying their OTT ad investments. Restaurants were a top category so far this year for Hulu, Paramount+, and Peacock.

“Quick service restaurants are making a strategic move by advertising heavily on streaming platforms,” said Krizelman. “With viewers at home, ads for restaurants are likely to prompt immediate orders, placing these brands right where viewers can act on them.”

Pharma companies, including AbbVie and GlaxoSmithKline (GSK), allocated nearly $84 million to OTT, achieving a 66 per cent increase in spending YoY. Significant contributions were made in arthritis prescriptions and OTC hair growth products. Pharma advertisers featured prominently in Discovery+ and Peacock’s top categories.

Retail and Technology Focus on Specific Platforms

Retail advertisers, spanning from car dealerships to general retailers, accounted for 14 per cent of Discovery+’s ad spend through October 2023, with general retailers like Target and Walmart contributing 28 per cent.

Retail also led contributions to Hulu (13 per cent) and Pluto TV (12 per cent), with car dealerships dominating Pluto TV’s retail spending.

Technology advertisers, making up 19 per cent of Max’s ad spend, were led by telecommunications companies like AT&T and T-Mobile (61 per cent), followed by software firms such as Adobe, Canva, and IBM (24 per cent).

Paramount+ gained nearly 10 per cent of its ad revenue from technology advertisers, totaling over $15 million, with T-Mobile and Verizon as leading spenders.