Research: US AVoD adoption faster than SVoD

June 15, 2022

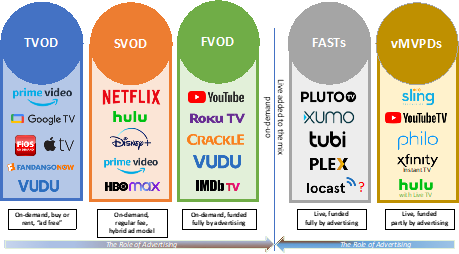

Findings from media evaluation specialist Comscore’s 2022 State of Streaming suggest that AVoD services are seeing adoption at a faster rate than SVoD, with a 29 per cent increase in US households streaming AVoDs in 2022 compared to 2020 vs a 21 per cent increase during the same period for SVoDs.

“While both ad-supported and subscription-based streaming services are growing in the US, we’re seeing that consumers are being more mindful of their budgets and leaning towards ad-supported services,” said James Muldrow, Vice President, Product Management at Comscore. “This makes sense as inflation continues to hit consumer’s wallets. The time is ripe for traditionally subscription-based streaming services like Netflix to consider launching an ad-supported tier to enhance their growth trajectory.”

Additional findings include:

- Households watched 5.4 streaming services per month as of March 2022, compared to 4.7 in March 2021, as ‘The Big Five’ streaming services became ‘The Big Six’ with the rise of HBO Max. In terms of audience overlap, Netflix has an 82 per cent overlap with the other top six streaming services, especially Amazon (66 per cent) and YouTube (66 per cent).

- Diverse audiences, including African American, Asian, American Indian, and Hispanic populations, are a key driver of streaming growth, now accounting for more than 40 per cent of Wi-Fi-enabled households watching connected TV (CTV) in the US In terms of the streaming platforms viewing days per household, African Americans over index for Amazon, FuboTV, YouTube, and Pluto.TV while Asians over index for HBO Max, Hulu, YouTube, and Sling. Accounting for the largest segment of diverse homes that stream, the Hispanic audience over indexes for Netflix, YouTube, FuboTV, and Sling.

- Smart TVs are the fastest-growing segment of streaming devices with 48 per cent growth YOY. Samsung still dominates the Smart TV arena with 26 per cent market share, but is down from 31 per cent in 2021 as other players gain momentum: Alcatel/TCL now accounts for 15 per cent and Vizio 14 per cent. But with the lack of a unified measurement for all players, the rise of Smart TVs is ripe for viewability fraud. Comscore has data from 13 million Smart TV devices in-house from two major ACR providers. While this data set contains high-quality return path data, it also unlocks new reporting challenges from a standards perspective.

- 79 per cent of Wi-Fi-enabled homes are watching streaming content on CTV devices and each such household is spending about 122 hours per month doing so, a 19 per cent growth from March 2021. Netflix captures the most hours per month watched at 43, followed closely by YouTube at 39 hours and Hulu at 33 hours.

- Amazon Prime Video has the highest resonance with the younger TikTok, Twitter, Snapchat & Twitch engagers, showcasing its strength in driving engagement with content & social marketing.